On 9 September, Mexico’s President Enrique Peña Nieto nominated Banco de Mexico’s Governor AgustÃn Carstens for a second six year term. Governor Carstens is has been credited for taming inflation to the lowest levels in 50 years. Carsten’s innovative approach has resulted in consistent, within target, inflation. This is in spite of the Peso’s 22% year over year decline against its major trade partner’s US Dollar. However, all is not well with the Mexican economy.

The record low 3% overnight rate has failed to ignite sustainable growth. However, much of the slowdown may be due to factors beyond the BOM’s control. Crude Oil is Mexico’s primary export at over 13% of all exports and an important source of government revenue. The impact of lower oil prices has been channeled into government spending reductions for as much as 0.7% of GDP; 2015 GDP expectation are currently 2.4%. Carstens is still focused on inflation, hinting of a benchmark rate increase, depending on US Fed actions. The influence of the US Dollar and US economy has also weighed on Mexican GDP.

Guest post by Mike Scrive of Accendo Markets

An important part of Mexico’s economic strategy is through a global portfolio of free trade agreements and partial scope agreements. Mexico accounts for 1.81% of total Japanese exports and Japan accounts for 1.13% of Mexico’s exports. Mexico imports automotive and electronics components from Japan; autos and computers are Mexico’s 2nd and 3rd primary export after crude oil. Lastly, Japanese auto manufactures, for example Toyota, has one assembly plant in Mexico, and a second planned. Hence, the MXN/JPY exchange is important to Mexico’s economy.

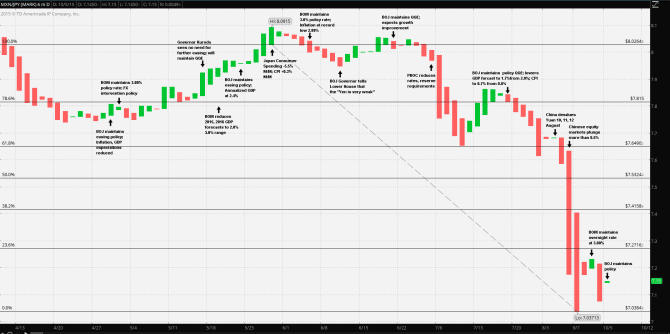

Over the past year the Yen has gained over 18% on the Peso, and a 10% gain from 15 July through 28 September. To be sure, this decline is precisely the opposite of what Mr. Carstens as well as Bank of Japan Governor Haruhiko Kuroda would like to have. The chain of events, in just this case, is a good example of the interconnectivity of currency markets among global economies. The BOM strategy since last March has been to maintain its benchmark rate while intervening in FX markets by selling $52 million USD daily and up to $200 million USD whenever the Peso declines more than 1.5% . The most recent extraordinary auctions occurred 19, 21 and 24 August. What precipitated the US Dollar auctions has little to do with the Yen or Peso. It was the devaluation of the USD pegged Yuan.

Although suspected by traders, the markets reacted to the devaluations with surprise. The first action occurred 11 August with a 2% devaluation of the Yuan, followed by market speculation that further devaluations would occur. Indeed, on 13 August the PBOC ordered banks to purchase Yuan at a PBOC designated price. The devaluations were followed by a series of actions, causing a spike in market volatility.

The devaluation and subsequent actions caused extreme volatility for emerging market currencies, including the Peso. On the other hand the Japanese Yen strengthened on its ‘safe-haven’ status against many majors as well as emerging markets, thus the precipitous drop of MXN/JPY over that period of time. A quick check with several EM currencies ZAR/JPY, TRY/JPY, THB/JPY, SGD/JPY, NZD/JPY, etc., all demonstrate the flight to quality trade in the days following the first PBOC 10 August move.

Preceding the August Yuan devaluations Both Governor Kuroda and Governor Carstens firmly maintained their respective policy strategies. Governor Carstens maintained an inflation dampening 3.00% overnight rate and continued selling US Dollars as well as repeatedly voicing his concerns about the prospect of a US Fed rate increase. The intent couldn’t be more clear: keep inflation in check and the Peso within a steady range of the US Dollar thus protecting trade with the US; 70% of the Mexican export market. Also, Governor Carstens needed to ‘buy time’ until that export market gained momentum.

Governor Kuroda is equally determined that Japan’s 65% of GDP QE along with Prime Minister Abe’s Three Arrow plan would eventually result in a revival in the economy and importantly a path towards 2% inflation. So concerned about a US Fed rate hike, and its ability to react to one, the BOM decided to change its regular meetings a day after each US Fed meeting

It may have been implicit in the focus on the domestic economy: Japan needed to protect its trade relations with its primary export partners, China at about 19% and that of the US, at about 18% of total exports.

It’s interesting to note the carry trade dynamics in this relationship. Governor Carstens is determined to keep the BOM overnight deposit rate at 3.00% while Governor Kuroda is just as determined to keep the benchmark basic loan rate at 0.3%; a 270 basis point spread. Governor Carstens is maintaining the 3% rate as a function of the US Fed rate. Further, the BOM is selling US Dollars to stabilize the Peso relative to the US Dollar. In 2014, Mexico accounted for 11% of US oil imports. Mexico’s triple credit rating is BBB+, A3, BBB+ stable. As long as the BOM can float debt and the government service that debt with oil revenues, the BOM can keep that strategy going for some time to come.

The BOJ released its latest policy statement on 7 October, stating that: “…With a view to encouraging a decline in interest rates across the entire yield curve, the Bank will conduct purchases in a flexible manner in accordance with financial market conditions… …The Bank will purchase exchange-traded funds (ETFs) and Japan real estate investment trusts (J-REITs)… …As for CP and corporate bonds, the Bank will maintain their amounts outstanding at about 2.2 trillion yen and about 3.2 trillion yen respectively…“ Hence, all indications are for maintaining a weaker Yen and suppressed rates. Lastly, if the BOJ decides anything in between meetings, it’s a near certainty it will be more Yen weakening.

However, the Yen has gained substantially on the Peso. With that in mind, in a world starved for yield, it’s reasonable to expect that the market will eventually force a reversal of MXN/JPY as demand for yield continues.

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.“