If the Federal Reserve is indeed data dependent and one figure stands out, it’s definitely the Non-Farm Payrolls report.

Here is the view from Bank of America Merrill Lynch on how to trade it:

Here is their view, courtesy of eFXnews:

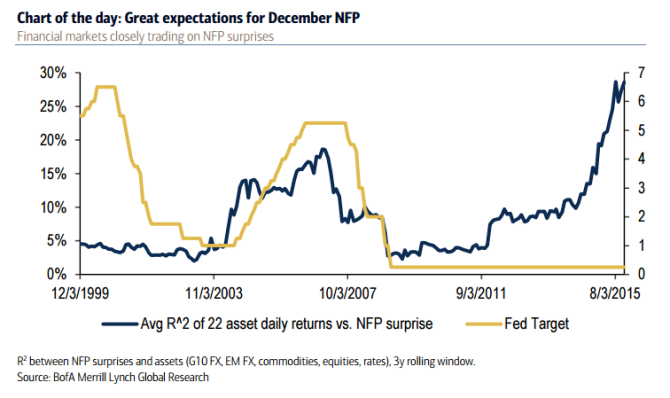

With the much-anticipated 16 December FOMC meeting around the corner, the 4 December US non-farm payrolls (NFP) is one of the most important remaining data points. The significance of recent NFP surprises in driving asset prices has been increasing since summer 2014 and is near historical highs (Chart of the day). We last observed this pattern of market behavior during the 2004-2006 Fed hiking cycle, suggesting this relationship exists due to market expectations for rate policy normalization.

During the previous hiking cycle the importance of NFP surprises rose ahead of the first hike and continued to rise until the end of the hiking cycle. Despite high anticipation for the next Fed hike, the importance of the employment report could remain elevated even after the initial liftoff. This relationship is particularly pronounced now as the Fed has adopted a data-dependent stance, and each NFP report will likely continue to play a key role in informing the path of subsequent Fed policy decisions.

Trading the report:

Our regression analysis also quantifies the expected reaction to different levels of NFP surprises and generates a few observations potentially useful for trading future events. Since 2012:

Among liquid G10 pairs EURUSD and USDJPY exhibit consistent reactions to NFP surprises, tending to move 0.7% in favor of the USD for a +100k surprise. Somewhat surprisingly, AUDUSD is the least consistent among G10 USD pairs.

USDZAR and gold tend to be the most sensitive overall.

Oil and equities have R-squared near zero, suggesting the market is concerned about the growth implications of a December hike. In previous hiking cycles, positive NFP surprises were beneficial for oil and equities as they signaled economic expansion. This time, the concern of higher rates deterring global growth is causing a break from the historical relationship.

10y Treasury yields tend to sell off 8bp on +100k surprises

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.