The euro could not recover on Draghi’s press conference and despite some calm in the Greek crisis.

What’s next for EUR/USD Here is the view from Morgan Stanley:

Here is their view, courtesy of eFXnews:

The performance of the EUR over the past week is another good example of how the removal of a major risk factor has not benefitted the relevant currencies, says Morgan Stanley.

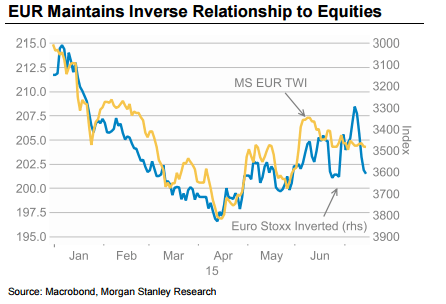

“Grexit has been avoided for the time being at least, with the EU and Greece agreeing to a plan to start negotiations for a third bailout. But the EUR was afforded only the briefest of rebounds. Our assumption that there could be a limited period where the inverse relationship between the EUR and equities markets broke down, allowing the EUR to rebound along with higher equity markets, has not materialized. Instead, the inverse correlation has remained in place, with the EUR coming back under pressure as equities rallied,” MS clarifies.

“With uncertainty regarding Greece diminished, we believe that investors will feel more comfortable reinitiating EUR shorts, as evidenced by the latest break in EURUSD below the 100 DMA,” MS argues.

“Draghi has reiterated that the ECB stands ready to act if needed, which could be enough to weigh on EUR, particularly if it supports equities, given the inverse relationship between European stocks and EUR…. We see this stance as reinforcing the inverse relationship between the EUR and risk assets. A rebound in equity markets will keep the EUR under pressure , we believe, and hence we maintain our overall bearish EUR view,” MS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.