Excellent news in the headline: 292K jobs were gained in December. In addition, November was revised to the upside: 257K instead of 211K originally reported. The unemployment rate is at 5% with a rise in the participation rate to 62.6%, which is good news. Wages remained unchanged in December at 0% but y/y it is at 2.5%, which is excellent news.

The US dollar is initially stronger but more so against commodity currencies as the dust settles. Once again, the trends seen earlier in the week of a weaker dollar against the euro and the yen while showing strength against all the rest is seen again.

The US was expected to create about 200K jobs in December. The unemployment rate was predicted to remain unchanged at 5% and the average hourly earning to repeat the 0.2% rise seen in November.

The markets had a very long week, suffering from the Chinese stock market crash, that affected all markets and triggered these risk on and mostly risk off swings: supporting the safe haven euro and yen while commodity currencies and the pound suffered.. Will this behavior change?

Data (updated)

- Non-Farm Payrolls: 292K (exp. +200K, last 211K before revisions)

- Participation Rate: 62.6% (62.4% last month )

- Unemployment Rate:5%(exp.5%, last month 5% before revisions)

- Revisions: ++50K (+35K last time)

- Average Hourly Earnings: 0% m/m, 2.5% y/y (exp. +0.2% m/m, last month 0.2% m/m, 2.3% y/y)

- Private Sector: TBA (ADP showed a huge 257K).

- Real Unemployment Rate (U-6): 9.9% (previous: 9.9%).

- Employment to population ratio: 59.5% (previous: 59.3%)

- Average workweek: 34.5K (last month: 34.5).

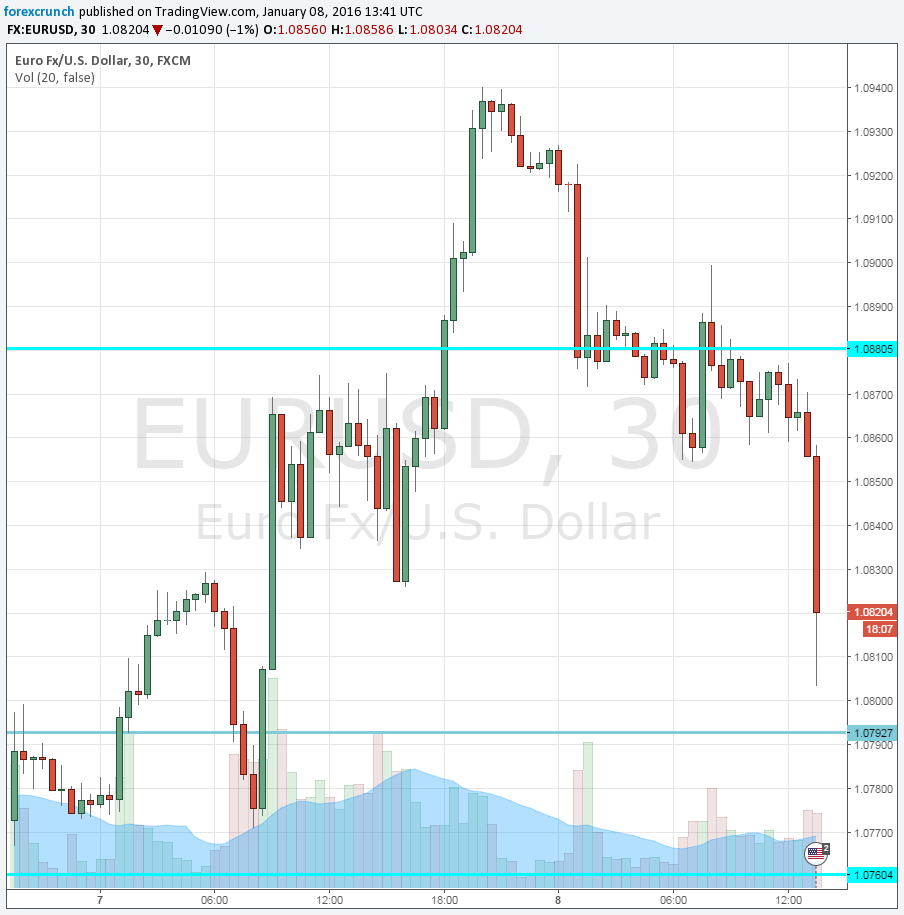

The US dollar is gaining ground but the moves are limited in comparison to such a positive surprise. For example, EUR/USD is down just 30 pips after things stabilized. Here is the chart:

Background

This is the first report after the first rate hike, seen on December 16th. This means that it means a bit less, because the next hike is not expected before March, which seems quite far away at the moment.

Preview: Trading the NFP with EUR/USD