The New Zealand dollar was hit by weak Chinese data, new worries from Europe and bad employment data at home. Retail sales and Producer Price Index figures are the main events this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD.

Last week, New Zealand’s job data revealed an unexpected contraction in the number of jobs dropping 0.1% in the second quarter while expected to gain 0.3%, following 0.4% increase in the first quarter. The weak reading also affected unemployment rate climbing 0.1% to 6.8% while forecasted to reach 6.5%. Will NZ job market continue to decline?

Updates: FPI dropped sharply in July, as the consumer index gained only 0.2%. Core Retail Sales, a key indicator, will be released later on Monday. The kiwi has edged upwards, as NZD/USD is trading at 0.8124. Core Retail Sales were up 0.9%, just below the estimate of 1.0%. Retail Sales jumped 1.3%, easily beating the market forecast of 0.7%. The kiwi lost some ground, dropping below the 0.81 line. NZD/USD was trading at 0.8090. Business NZ Manufacturing Index will be released later on Wednesday. NZD/USD has steadied after earlier losses. The pair was trading at 0.8046.

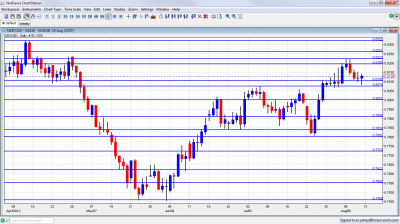

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- FPI: Sunday, 22:45. New Zealand food prices jumped to a 12 month high of 1.4% in June following a 0.3% gain in the previous month, indicating higher seasonal prices for tomatoes and other fresh produce and a recorded jump for chocolate.

- Retail sales: Monday, 22:45. New Zealand retail sales more than doubled the drop predicted by analysts plunging 1.5% in the first quarter from a 1.8% gain in the fourth quarter of 2011. Consumer spending became sluggish after the successful second half of 2011 flared by tourism tied to the Rugby World Cup. Meantime Core sales excluding automobiles and energy produce declined 2.5% from a 1.4% gain in the fourth quarter of 2011.

- Business NZ Manufacturing Index: Wednesday, 22:30. New Zealand’s manufacturing sector contracted in June to 50.2 offsetting last month’s reading of 55.8 although activity continued to expand. The general belief is that NZ manufacturing is on a growth trend with improved domestic construction. PMI also showed increase in new orders. Construction is expected to further pick up in the following months boosting NZ economic growth.

- PPI Input/output: Thursday, 22:45. Input prices increased 0.3% the first quarter above predictions of a flat reading and below the 0.5% gain in the fourth quarter of 2012. Meantime PPI input shows a 0.1% decline as New Zealand producers’ received lower prices for products in the first quarter.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar tried moving to higher ground early in the week, but found fierce resistance at 0.8220, a line that didn’t appear last week. After some range trading on higher ground, the pair changed direction, fell, and eventually closed at 0.8128.

Technical lines, from top to bottom:

0.8573 capped the pair in September 2011 and is distant resistance. 0.8505 served as support at the same time.

0.8470 was the swing high seen in February. 0.84 was resistance back in February 2012. 0.8320 was a wing high in April, just before the big dive.

0.8260 capped the pair during March, and is stubborn resistance. 0.8220 worked as stubborn resistance in August 2012 and joins the chart.

0.8195 was resistance in the past and now has a new role after capping the pair in August 2012. 0.8105 is the new peak reached in July 2012 and should be closely watched on any upside movement.

0.8075 was the peak in July 2012 and replaces other lines in this region. This is the highest in 3 months. The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance. It was hit by the recent moves and somewhat weaker now.

Another round number, 0.79, is key resistance, after being a very distinct line separating ranges. It proved its strength also in June 2012. 0.7840 provided support for the pair several times during June 2012 and also worked as resistance back at the end of 2011.

The round number of 0.78 is significant support after working as such in July 2012. 0.7723 supported the pair back at the beginning of 2012 and also worked in the other direction in June 2012.

0.7620 provided support in May 2012 and is resistance once again, although weaker than in previous weeks. 0.7550 is resistance once again, even after the breakdown. It was a very distinct line separating ranges and had a similar role back in January.

I am bearish on NZD/USD

With worries from China and weak employment data in Q2, the picture is much darker now for the kiwi, that enjoyed strong GDP in Q1.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the Swiss Franc, see the USD/CHF forecast.