The New Zealand dollar enjoyed a second week of gains through the holiday week. Also in the first week of 2012, there are no publications of economic indicators, so yet again, the outlook is technical only.

End of year adjustments pushed the kiwi higher, despite worries from China. Will the Chinese landing hurt the kiwi in 2012? The first week of the year could provide an indication.

Updates: The kiwi enjoyed a return of China to manufacturing growth and optimism in Europe. NZD/USD already climbed to 0.79, but couldn’t continue higher as new worries came from Europe. Current range: 0.7840 to 0.79. New worries from Germany and France ended the party, and NZD/USD dropped down to 0.78 once again.

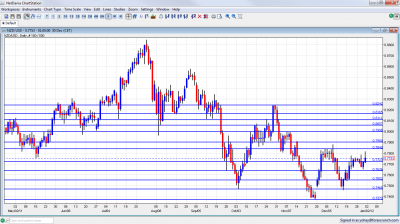

NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

NZD/USD Technical Analysis

The kiwi began the week by floating above the 0.7723 line (discussed last week) before dropping, only to bounce back up and close the year at 0.7753, hardly changed for the year.

Technical lines, from top to bottom:

We start from a higher point now: 0.8240 was a peak in October and also back in May 2011. 0.8165 provided support for the pair at several occasions, last seen in October.

81.10 switched positions from support in August to resistance later on and is a minor line on the way up. 0.8060 was resistance in October and support beforehand.

The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance. Another round number, 0.79, is now minor resistance, after being approached in December.

0.7840 capped the pair in October and became much stronger in December, holding the range. The pair approached in the last days of 2011, but couldn’t really challenge it. 0.7723 proved to be a significant line – very distinct in separating ranges and the bottom border of the range during the fall of 2011. It is now somewhat weaker.

0.7637 was a swing low in September and provided its strength in December as a swing low. It is a still strong, after capping a recovery attempt in December. 0.7550 now has a stronger role after working as a very distinct line separating ranges.

It had a similar role back in January. 0.7470 was the trough in October and worked as perfect support in December. The fresh low of 0.7370 seen in November is the lowest level since March and will be tested on the way down.

0.7340 was minor support back in February and March and is minor now. The last line is the veteran 0.72, which worked as support many times in the past.

I am bearish on NZD/USD

With clouds becoming darker in Europe and the prospects of a significant Chinese fall becoming apparent, the kiwi might be pressured after all market participants return to the market.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.