PMI Data Points Higher

Data releases over the start of the year reflect a turn higher in global inflation and global growth. Indeed, the global composite PMI marked a post- 9/11 high in December. Typically, higher oil and other commodity prices alongside weaker currencies in some areas foster these conditions. There is now a growing indication that these price pressures, which are externally driven, are moving further up the price-formation chain and feeding into output prices, especially global manufacturing.

Looking ahead, the effects of these pressures on domestically orientated prices will vary between countries depending on a variety of factors such as economic cycles, labor market conditions, fiscal policies and the extent of competition in any one sector. However, central banks are keenly watching the current rise in inflation and inflation expectations. Most are likely to maintain a neutral stance for now, with some banks adopting a hawkish bias. At the hawkish side of the skew are the US and Mexico where the Fed and Banxico are widely expected to step up their tightening this year. On the other side of the fence are countries such as Russia, Brazil, Argentina and Chile where loosening is expected to increase to fight stronger currencies and falling inflation.

Tighter US Labour Market Poses Upside Inflation Risks

In the United Sates, labor market conditions have tightened significantly. The ratio of unemployed persons to job openings is at record lows, quits are rising, layoffs have decreased, and small businesses are reporting substantial difficulty in finding qualified applicants for jobs. With the unemployment rate already below the threshold that the Fed deems its equilibrium level, there is the risk that the US labor market is starting to overheat. Average hourly earnings have risen 2.9% in the 12 months to December 2016 and with the unemployment rate likely to fall further, a further increase in wage costs above the level consistent with 2% inflation seems likely.

At the same time, producer prices are also rising. The number of firms reporting increased prices in the ISM survey is at its highest level since 2011. Import prices have risen steadily over the last twelve months, despite a stronger Dollar. It is not yet clear how the current optimism being recorded in consumer and business surveys will drive pricing behavior, but risks appear to be skewed to the upside. Forecast stronger demand and increased costs will affect pricing behavior even ahead of demand coming through. Potential adjustments to the US tax code, through border tax adjustments or trade restrictions, could add further upward price pressure.

The Fed & Inflation

If Trump’s plans are even only partially enacted then, the Fed is still behind the curve and as such, upcoming FOMC meetings are likely to be particularly sensitive to upward surprises in CPI. In their recent meeting the Fed described price expectations as “reasonably” well-anchored – revealing a degree of concern. The risk here is that the Fed pursues a more aggressive tightening cycle than the market is currently forecasting, due to stronger CPI advances.

Eurozone Inflationary Pressures Building

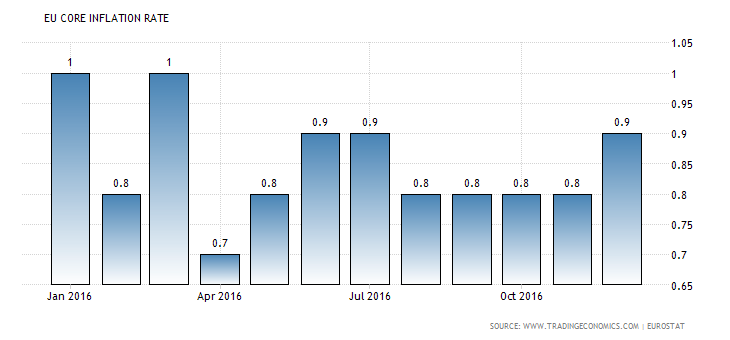

Favorable energy-price-aligned base effects are set to push inflation higher in the Eurozone. Looking past the volatile headline rate, core inflation is likely to remain in center stage due to the ECB noting their concern about the lack of sustained pickup in underlying inflation. There are various contributing factors that suggest upward momentum in core inflation from Q2 onwards such as a weaker EUR exchange rate, the rising trend in some commodity prices and increased inflation expectations.

At the upcoming ECB meeting this week the central bank is likely to highlight the diminished risk of deflation, striking a cautiously optimistic tone. However, ECB chief Draghi is also likely to highlight that inflation remains low and far from the ECB’s aim of a sustainable 2%, supporting the need for continued accommodation until end 2017 where beyond that, the ECB is likely to scale back purchases into mid-2018 when the program is completed.

GBP Weakness to Fuel Surge In UK Inflation

The landslide in Sterling over the last seven months will translate into a sharp uptick in UK inflation. Although the upcoming December reading this week is likely to reflect only limited pressure, from this month on CPI should start to print strongly. Alongside the dramatically weaker exchange rate, higher energy prices should also feed in. The issue for the BOE is that they are also facing the prospect of a slowdown in growth and these combative forces make policy decisions difficult. The BOE isn’t likely to shift from its neutral bias in the near term but could move to a hiking bias if growth can survive 2017 without any detrimental effects.

Clearly, the inflation environment is reflecting a definite shift for some of the key global economies, and forthcoming inflation releases will be closely watched by markets as investors look to anticipate the subsequent policy action by central banks.