The Australian dollar took advantage of a broadly-weak US dollar, gaining over 100 points. AUD/USD closed the week at 0.7774. The upcoming week has eight events, highlighted by Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

The US dollar took it on the chin last week from the major currencies, as the markets reacted to disappointing US economic reports, including retail sales and housing data. There was better news late in the week as consumer confidence shot higher. Australian data also contributed to the Aussie’s rally, as Australian employment numbers were unexpectedly strong.

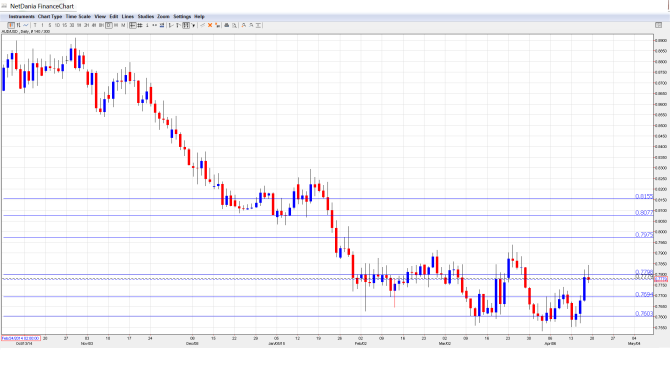

[do action=”autoupdate” tag=”AUD/USDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- RBA Governor Glenn Stevens Speaks: Monday, 16:30. Stevens will speak at an event in New York City. A speech that is more hawkish than expected is bullish for the Australian dollar.

- Monetary Policy Meeting Minutes: Tuesday, 1:30. The minutes will provide details of the RBA’s policy meeting earlier this month. Analysts will be looking for any hints about a rate cut, which would likely push the Aussie lower.

- MI Leading Index: Wednesday, 00:30. This is a minor event as most of the data has already been released. The index improved to 0.3% in February, its best reading since August 2013.

- CPI: Wednesday, 1:30. CPI, released each quarter, is the primary gauge of consumer inflation, and an unexpected reading can have a substantial impact on the direction of AUD/USD. The index continues to fall and came in at just 0.2% in Q4. The downward trend is expected to continue in Q1, with a forecast of 0.1%.

- Trimmed Mean CPI: Wednesday, 1:30. This indicator removes the most volatile items in CPI, resulting in less distortions in the underlying trend. The index improved to 0.7% in Q4, within expectations. Little change is expected in the Q1 report.

- NAB Quarterly Business Confidence: Thursday, 1:30. The business sector is a key engine of economic growth, and increased confidence usually translates into increased hiring and spending. The indicator slipped to 2 points in Q4, compared to 6 points in the previous three quarters. Will the indicator bounce back in Q1?

- Chinese HSBC Flash Manufacturing PMI: Thursday, 1:45. The Aussie is sensitive to key Chinese data such as PMIs, as the Asian giant is Australia’s number one trading partner. The indicator continues to trade close to the 50-point level, which separates between contraction and expansion. The PMI dipped to 49.2 points in February, shy of the forecast of 50.5 points. Little change is expected in the March report.

* All times are GMT.

AUD/USD Technical Analysis

AUD/USD started the week at 0.7664 and slipped to a low of 0.7553, as support held firm at 0.7528 (discussed last week). The pair then reversed directions and climbed to a high of 0.7843 late in the week, before closing at 0.7774.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

We start with resistance at 0.8150. This line has remained intact since late January.

0.8077 was an important resistance line in January.

0.7978 was an important cap back in January 2007.

0.7799 was tested by the pair and is currently a weak resistance line. It could see further action early in the week.

0.7692 has switched to a support role following the Aussie’s strong gains.

0.7601 has strengthened as a support line. This line has been busy in the month of April.

0.7528 is the next support level.

0.7403 has held firm since May 2009. At that time, the Aussie was in the midst of a rally which saw it climb above the 0.94 line.

The final support line for now is 0.7283.

I am bearish on AUD/USD.

AUD/USD pushed higher last week, as the greenback had a dismal week against its rivals. However, market sentiment remains high over the US economy, and a few strong US releases could quickly erase last week’s poor performance by the US dollar. The RBA wants to see an exchange rate closer to 75 cents, so we can expect the central bank to continue to “talk down” the pair. A rate cut is not expected, but remains a distinct possibility.

In our latest podcast, we talk about The Confetti Lady that moved Draghi but not Markets

Subscribe to Market Movers on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZDUSD forecast.