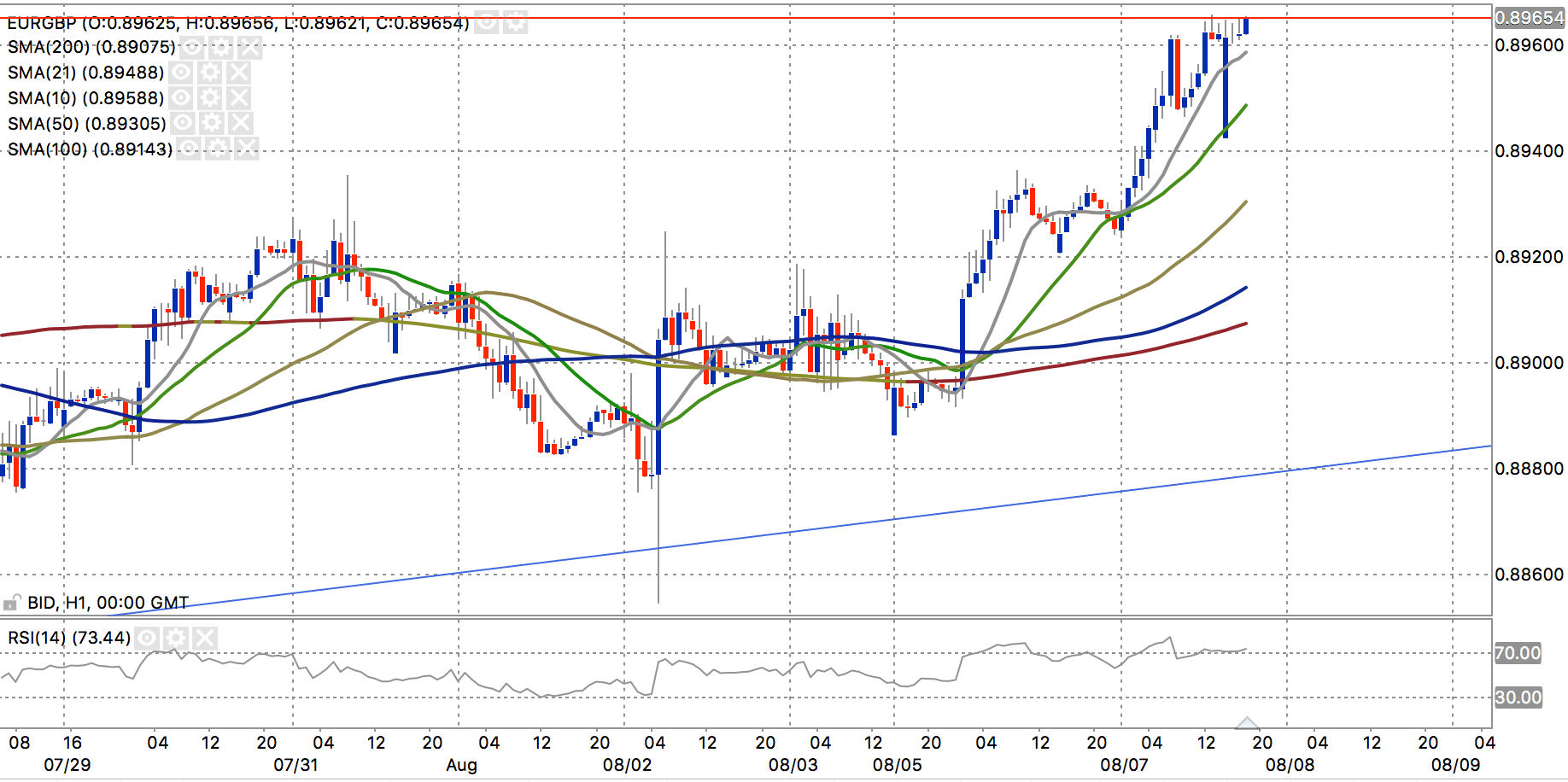

There was some volatility in EUR/GBP on the hourly sticks in early Asia with the pair falling away from the 0.8965 highs down to 0.8942 before catching a bid again falling back in line with the dominant trend. The pair has otherwise been on a steady climb from 0.8923 European lows while Brexit concerns remain the key catalyst for a better bid cross.

0.6940 has been a historical support/resistance level and should be watched for pullbacks. Meanwhile, the cross is otherwise supported by the 21-D SMA at 0.8897. 0.9034 as the October 2017 high on the wide comes in as the key upside target from here. On the flip side, on a break to the downside and below the 2-month uptrend at 0.8877, the 0.8720 triangle lows, (the 15th June low), guard the double bottom lows at 0.8697. 0.8620 protects a run towards 0.8526 as being the 78.6% retracement of the move from 2017 on the wide.