After counting nearly 100% of the votes, the victory for center-right New Democracy is clear. Talks are set to begin for a pro-bailout coalition.

While there may be some hurdles in the talks, a new government will likely be formed soon. However, the initial cheer by the markets was reversed, as expected.

Greek results – Pro-bailout coalition, but no wide popular support

The party led by Antonis Samaras won 29.66% of votes. Greek law gives the winning party an additional 50 seats in the 300 seat parliament. So, New Democracy will get 129 seats. The center left pro-bailout PASOK party will get 33 seats, after it came in third with 12.28% of votes.

Together, they have a comfortable majority. PASOK indicated that it won’t join the coalition without the participation of anti-bailout SYRIZA, which came in second with 26.89% of votes and 71 seats in parliament. However, this may be part of the tactical games.

SYRIZA conceded defeat and said it will stay in opposition. If we judge from the past, the new government will likely fail to improve the situation and will crumble down. With another round of austerity, SYRIZA could come out as the winner in the next round of elections that could come early once again.

Looking at the wider political picture, the pro bailout parties gained 41.8% of votes and anti-bailout parties (from neo-Nazi Golden Dawn to the communist party) received 46.2% of the votes. So, support for the bailouts and austerity is actually quite weak.

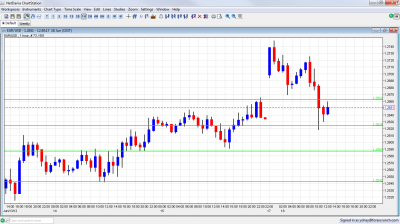

Market Reaction: Up and then Down

As expected in the preview to the Greek elections, the markets opened with a gap but retreated: EUR/USD reached 1.2748 at the early hours. Asian stock markets also cheered.

However, when the dust settled, markets recalled the trouble Greece still encounters and a bigger European country on the other side of the Mediterranean: Spain. Yields on Spanish bonds crossed the “bailout line” of 7% once again, and it is becoming clear that the 100 billion euros bailout for banks will not be sufficient.

EUR/USD fell and closed the gap. At the time of writing it is at 1.2648, 100 pips lower than the peak and around the closing levels seen on Friday.

For more on the euro, see the EUR/USD forecast.