The dollar weakening and ‘risk-assets’ gaining in early Monday trade as the leading candidate to be chairman of the US Federal Reserve pulls out of the race. There are two reasons why this matters so much. Firstly, Larry Summers was seen as more concerned about the unintended consequences of quantitative easing than the current chairman and also the other contender in the race, current Vice-Chair Janet Yellen. So the Fed was seen reducing QE and raising rates earlier with him at the helm.

The second reason why it matters is that the Fed is so influential in supporting asset markets, such as stocks, gold and emerging markets with its QE policies. So the initial reaction is understandable, but may struggle to be sustained. If anything, the reaction in markets could make it more likely that the Fed does reduce the monthly pace of asset purchases (so-called tapering) at its meeting this week, so the initial negative dollar reaction may struggle to be fully sustained by the end of the week.

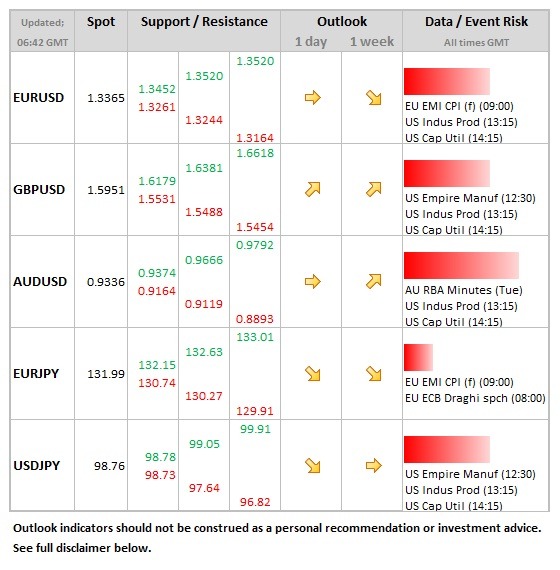

Data/Event Risks

EUR: Just final CPI data for the Eurozone, with confirmation of initial 1.3% reading expected. There is a small risk event for the single currency should we see a revision of this provisional reading.

USD: Some interest with the industrial production and capacity utilisation data today. Production seen rising 0.5%, with capacity utilisation expected to rise from 77.6% to 77.9%. Weaker readings on both would be dollar negative, but only modestly so.

AUD: The minutes to the latest RBA meeting are released Tuesday. At this meeting, the committee adjusted the language in the statement, leaning towards a more neutral outlook for policy. This provided further impetus to the current reversal of the Aussie, so if the discussion adds to the perception that further rate cuts are off the agenda, the Aussie could receive further near-term support.

Latest FX News

USD: EURUSD initially around 70 pips on the back of the news that Summers pulled out of the rate for Fed chair, meaning Fed seen as holding stimulus for longer. The latest events in the Syrian crisis (military action less likely from US) have also been supportive to this move.

EUR: Increased focus on the German election this coming weekend, but with FDP having a weak showing in state elections in Bavaria over the weekend, the main focus is whether they will have enough votes to maintain their current place in a Merkel coalition. But CSU did well at weekend elections, which is overall positive for the single currency.

AUD: The Aussie briefly pushed above last week’s high in early Asia trading to just below the 0.94 level, but has since retraced. Minutes to the September policy meeting will be the focus for tomorrow.

Further reading:

Larry Summers will NOT replace Bernanke – dollar falls

US Consumer Confidence falls sharply – dollar retreats