The US dollar has been on its back foot for quite a while, suffering from weakness in the US economy among other issues. Can this turn around though? Here is an explanation from CIBC:

Here is their view, courtesy of eFXnews:

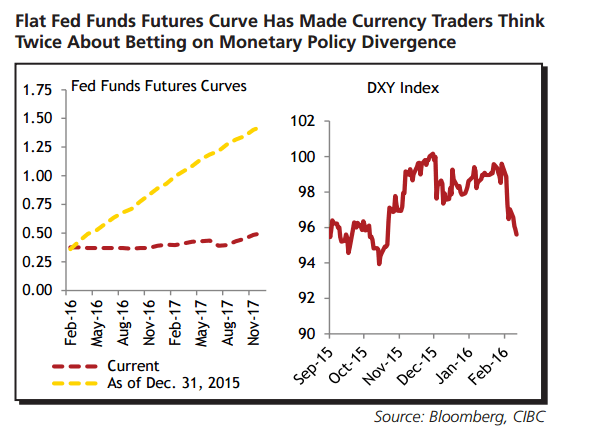

The fed funds futures curve is now essentially flat, with market-based expectations pointing to a pause in the rate hike cycle until at least the end of 2017. That’s in sharp contrast to end of 2015, when futures were suggesting that the central bank would raise rates at least four times over the following two years.

The belief that monetary policy divergence is no longer on the table has hit the USD too. After peaking in late 2015, the DXY Index has declined sharply.

But will the Fed really be one and done? While we agree that volatility has delayed a hike until June, the fundamental outlook is only modestly weaker and should still support a handful of rate increases over the next 24 months.

Currency traders should, therefore, beware of a near-term reversal in the USD.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.