Idea of the Day

Back in August, the Bank of England formally introduced forward guidance on policy, with the aim of avoiding an upward drift in market interest rates, something that was in evidence in July as expectations for Fed tapering were building. Since then, the Fed has not tapered but UK data has continued to improve, suggesting growth forecasts will be again revised higher tomorrow. The key focus will be on the Bank’s employment project, because at the time it was seen as relatively bearish on the prospects of it being achieved. We are likely to see the time at which the 7.0% level is reached bought forward by one to two quarters, which would certainly offer support to sterling, on the basis that there are no major surprises in today’s labour market report.

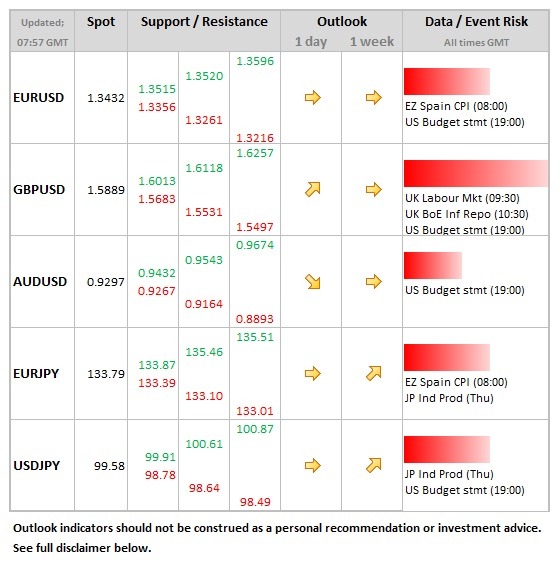

Data/Event Risks

GBP: After yesterday’s surprise fall in headline inflation, labour market data and the Inflation Report dominate today. There is an expectation that we will see the Bank take a more optimistic stance on when the 7.0% threshold for unemployment will be achieved (i.e. earlier than mid-2016). Further move lower in the unemployment rate when official data is released is also expected. Overall, risks are that a firmer tone emerges as a result, the 1.60 barrier possibly in sight again on sterling.

Latest FX News

EUR: During Tuesday the euro continued to retrace the sell-off seen since the rate cut of last week, with the pre-ECB level having been surpassed in overnight trading. This fits with our feeling earlier in the week that the rate cut was not necessarily that bearish for the single currency.

GBP: Hit hard initially by the surprise fall in headline inflation to 2.2%, but most of the losses recovered on cable but losses vs. EUR maintained as euro tone generally firm.

AUD: There continues to be a heavy feeling on the Aussie, struggling to react to good news. The generally firmer dollar tone seen yesterday has pushed the Aussie below the 0.93 level and there remains a continued the tendency towards underperformance on the majors.

NZD: The kiwi firmer as the central bank warns of the possibility of a firmer currency when rates start rising, most likely next year. NZD briefly below 0.82 overnight, but downward trend on AUDNZD more firmly established as a result, the lowest for 6 weeks at 1.1291.

Further reading:

NZD/USD: Trading the New Zealand Retail Sales

QE tapering in December still unlikely; EUR could do well towards year end