Another small blow to the already suffering US dollar: consumer confidence dropped to 90 points in the first read for March, worse than 91.7 expected and the figure seen last time.

The US dollar is actually bouncing a bit in the immediate aftermath and perhaps this has to do with the “quadruple witching” due today.

Also the internal figures of this survey do not look too great: the Conditions component dropped from 106.8 to 105.6, below forecasts for 107 points. The Expectations component fell to the round 80 level, below 81.9 last time and 82.3 predicted.

Inflation expectations for 1 year and 5 years did advance from 2.5% to 2.7%. This is the bright spot in the report, and it also contradicts the big slash in inflation forecasts made by the Fed. Yellen and co. did what they did on the day that the US reported a rise in core inflation to 2.3% y/y.

US consumer confidence was expected to improve in March according to the preliminary read from the University of Michigan: to 92.2 points from 91.7 in the final read for February.

The US dollar was attempting a recovery earlier in the day, but it didn’t really go far.

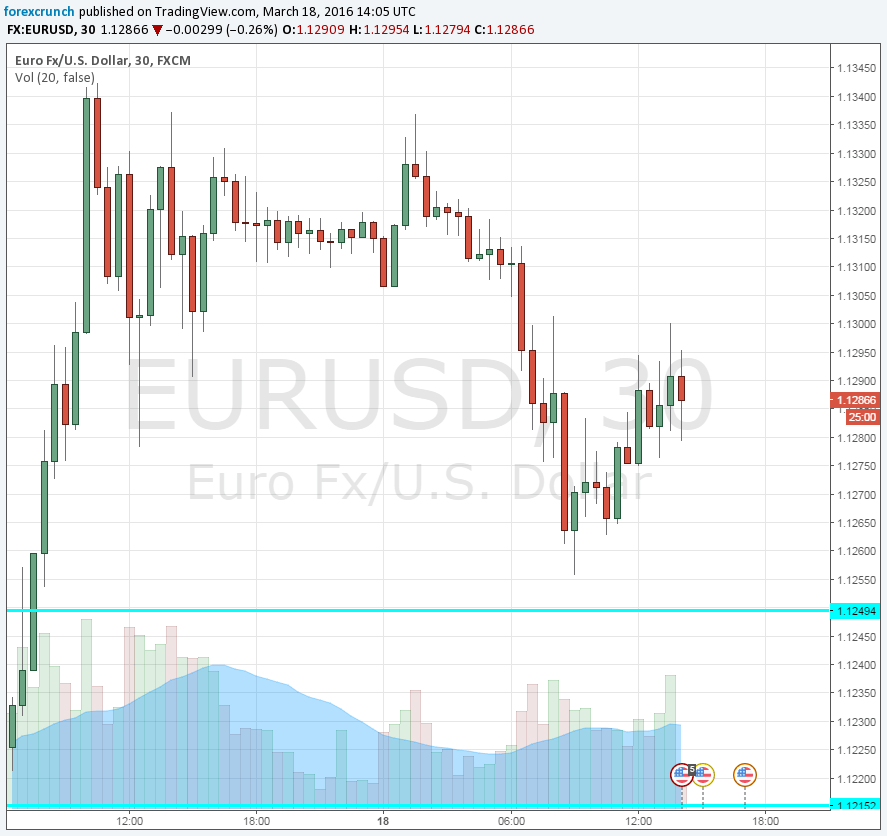

EUR/USD traded around 1.1290 before the release.

The Federal Reserve devastated the greenback with an extremely dovish decision. They saw the quarter glass half empty.

Here is how things look on the EUR/USD chart. Note that we have some FOMC members speaking later today.