The Canadian dollar rally continued last week, gaining about 240 points against the US dollar. USD/CAD closed the week just above the 1.33 line and is trading at its lowest level since early December. This week’s highlights are the Overnight Rate and Employment Rate. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The Canadian dollar received a boost from GDP, which posted a gain of 0.2%, ahead of the forecast of 0.1%. In the US, a weak services sector report weighed on the greenback, and an excellent Non-Farm Payrolls report couldn’t blunt the loonie rally. Wage growth in the US fell by 0.1%, well below predictions.

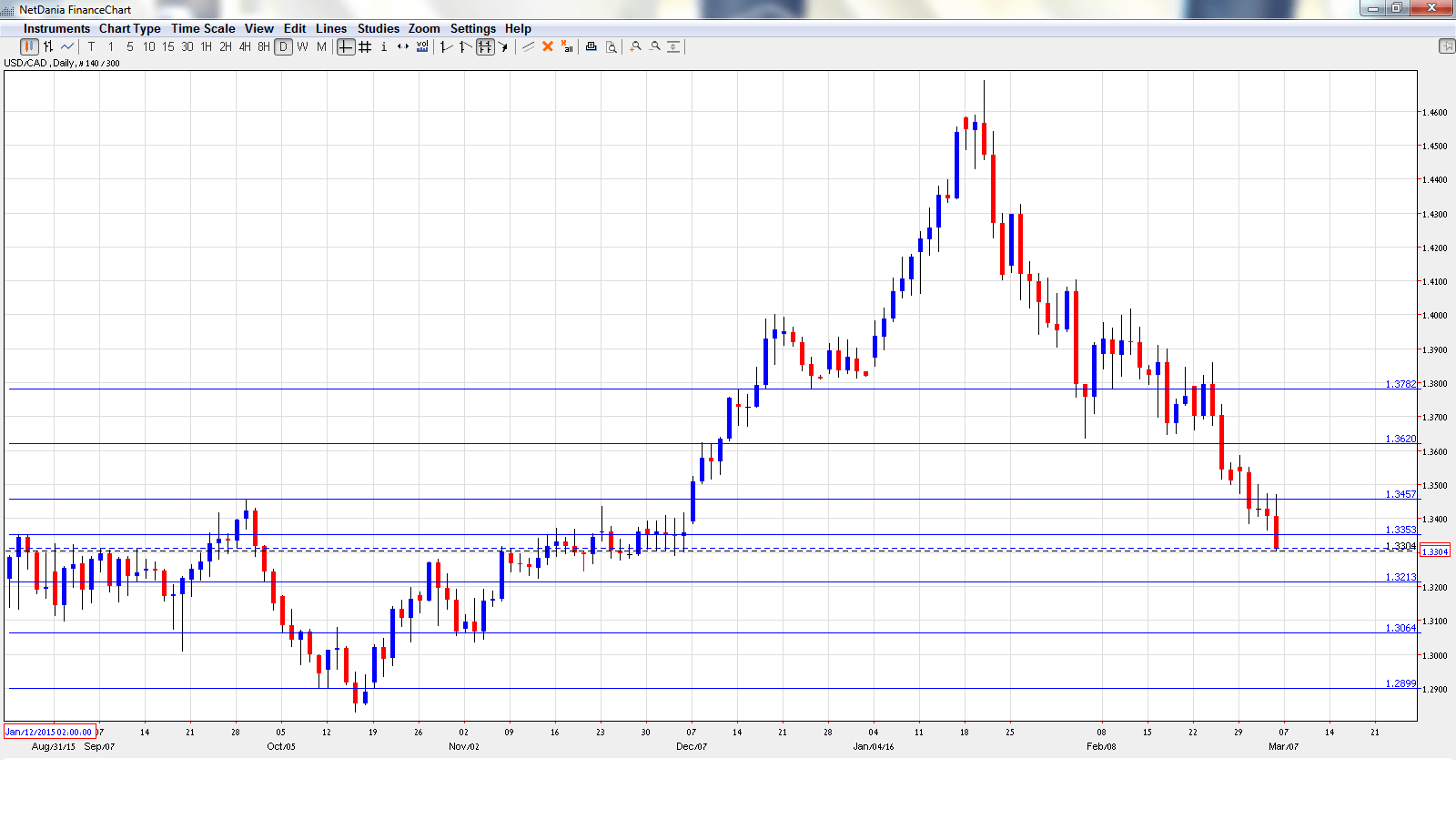

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Housing Starts: Tuesday, 13:15.Housing Starts provide a snapshot of the strength of the housing sector. The indicator dipped to 166 thousand in January, its weakest gain in 11 months and below expectations. The markets are expecting a strong turnaround in February, with an estimate of 181 thousand.

- Building Permits: Tuesday, 13:30. Building Permits continue to show strong fluctuations from month-to-month. In January, the indicator jumped to 11.3%, compared to the plunge of 19.6% a month earlier. Will the indicator repeat with a strong gain in February?

- Overnight Rate: Wednesday, 15:00. There was a lot of speculation that the BoC would lower rates in January to 0.25%, but the central bank held back and the rate remained at 0.50%. The markets are not expecting any change in the upcoming decision, which will be announced in a rate announcement.

- NHPI: Thursday, 13:30. This housing price index dipped to 0.1% in December, shy of the forecast of 0.3%. Another weak gain is expected, with an estimate of 0.2%.

- BOC Governor Steven Poloz Speaks: Thursday, 21:15. Poloz will speak at event in Ottawa. The markets will be listening closely for any hints regarding the BoC’s future monetary policy.

- Employment Rate: Friday, 13:30.The week wraps up with one of the most important economic indicators, Employment Rate. The indicator sagged in January to -5.7 thousand, well off the estimate of +5.2 thousand. The markets are projecting much better news in February, with the estimate standing at 10.2 thousand. The Unemployment Rate is expected to remain at 7.2%.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3550 and quickly climbed to a high of 1.3587, as resistance held firm at 1.3620 (discussed last week). It was all downhill from there, as the pair dropped all the way to 1.3305. USD/CAD closed the week at 1.3313.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

With USD/CAD posting strong losses, we start at lower levels:

1.3784 was a cushion in February.

1.3620 held firm as USD/CAD moved upwards at the start of the week before retracting.

1.3457 has switched to a resistance line following sharp losses by USD/CAD.

1.3353 has reverted to resistance for the first time since early December. It is a weak line and could see action early in the week.

1.3213 is an immediate support line.

1.3064 is protecting the symbolic 1.30 line.

The round number of 1.2900 was a cushion in October. It is the final support line for now.

I am neutral on USD/CAD

The Canadian dollar continues to climb, but traders should keep in mind that the current rally is essentially a correction of the huge drop the currency sustained in December and early January. In the US, a March hike is unlikely, even with a strong NFP report, but the Fed bias remains towards tightening. This monetary divergence favors the US dollar. If oil prices continue to rise, the Canadian dollar could push higher.

Our latest podcast is titled Drum roll for Draghi

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.