The Canadian dollar posted modest gains last week, as USD/CAD closed just below 1.2890. There are eight events on the schedule this week. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

It was a disappointing week for US releases, as poor retail sales and weak manufacturing data out of the US helped the Canadian dollar post gains for a third straight week. There were no Canadian major releases last week.

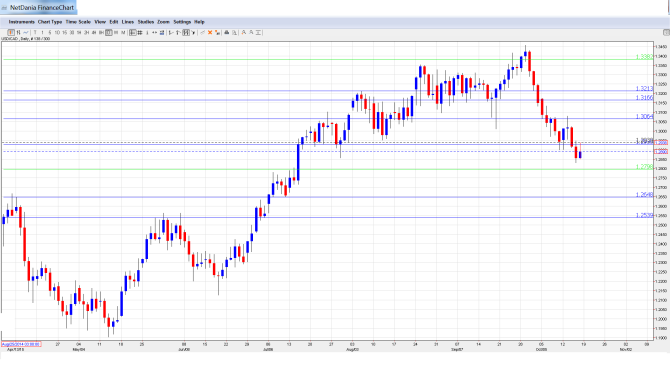

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily chart with support and resistance lines on it.

- Federal Election: Monday, All Day. Canadians go to the polls on Monday, and Prime Minister Stephen Harper, governing Conservatives are trailing in the polls. An uncertain result, such as no party gaining a majority, will result in an uncertainty and could hurt the US dollar.

- Wholesale Sales: Tuesday, 12:30. Wholesale Sales softened in August, slipping to just 0.0%, compared to a gain of 1.3% a month earlier. This was short of the estimate of 0.3%. Little change is expected in the September reading, with an estimate of 0.2%.

- BOC Monetary Policy Report: Wednesday, 14:00. This report is released quarterly, and provides details about the central bank’s views regarding monetary policy, especially interest rate decisions.

- BOC Rate Decision: Wednesday, 14:00. Despite a weak economy, the BOC is not expected to lower the current interest rate of 0.50% in the October decision. The BOC has been aggressive when it comes to rate levels, cutting rates twice so far in 2015. A press conference hosted by the BOC will follow.

- Core Retail Sales: Thursday, 12:30. Core Retail Sales slipped to 0.0% in July, missing the estimate of 0.4%. Core Retail Sales does not include the most volatile events, such as automobile sales.

- Retail Sales: Thursday, 12:30. Retail Sales showed little change in the July report, with an estimate of 0.5%. This matched the forecast. Will the indicator hold its own in August?

- Core CPI: Friday, 12:30. The index improved slightly in August, with a small gain of 0.2%. This matched the forecast.

- CPI: Friday, 12:30. CPI is the primary gauge of consumer inflation. The index dipped to 0.0%, matching the forecast, but also underscoring persistently weak inflation levels.

* All times are GMT.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.2952 and touched a high of 1.3080. The pair then reversed directions, dropping to a low of 1.2830, as support held firm at 1.2798 (discussed last week). USD/CAD closed the week at 1.2890.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

1.3382 is a strong resistance line.

1.3213 was an important cap in early August.

1.3165 has strengthened as the pair continues to move lower.

1.3063 was tested in resistance and is an immediate line.

1.2930 has switched to resistance for the first time since July.

1.2798 is providing support.

1.2648 was an important cap in May and June.

1.2541 is the final support level for now.

I am bullish on USD/CAD

The US may be moving away from a rate hike in 2015, which is not a sign of confidence in the US economy. This does not bode well for the Canadian dollar, as Canada is heavily reliant on the US economy. With the Canadian economy showing some weakness, there is still the possibility of a rate cut by the BOC.

In our latest podcast we analyze Varoufakis’ 4 problems and 4 solutions, and more

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.