The Canadian dollar had a week to forget, losing over 250 points last week. USD/CAD closed the week at 1.3163. This week’s key event is GDP. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

USD/CAD posted sharp gains after the BOC presented a pessimistic growth report, as low oil prices continue to hobble the Canadian economy. There was more bad news for the loonie, as Core Retail Sales and Core CPI both missed their estimates. In the US, housing data and unemployment claims were better than expected.

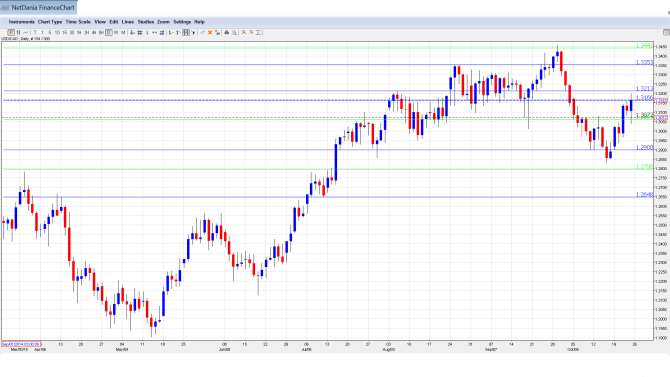

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily chart with support and resistance lines on it.

- BOC Deputy Governor Timothy Lane Speaks: Tuesday, 15:20. Lane will speak at an event in Halifax. A speech which is more hawkish than expected is bullish for the Canadian dollar.

- RMPI: Tuesday, 12:30. This index measures inflation in the manufacturing sector. The indicator has struggled, posting sharp declines in the past two months, with the August reading coming in at -6.6%. Will the indicator improve in the September report?

- GDP: Friday, 12:30. Canadian GDP is released every month, unlike most Western economies which release GDP every quarter. The July reading dipped to 0.3%, just above the estimate of 0.2%. The downward trend is expected to continue, with an estimate of 0.1% for August.

* All times are GMT.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.2916 and quickly touched a low of 1.2900. The pair then reversed directions, climbing all the way to 1.3198, as resistance held firm at 1.3213 (discussed last week). USD/CAD closed the week at 1.3163.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

With USD/CAD posting sharp gains, we begin at higher levels:

1.3587 is a strong resistance line. It was last tested in June 2004.

1.3443 is next.

1.3353 was a cap in September.

1.3213 held firm as the pair posted sharp gains.

1.3165 is a weak resistance line.

1.3063 is an immediate support line.

1.2900 continues to be busy and was tested last week in support.

1.2798 is next.

1.2648 was an important cap in May and June. It is the final support line for now.

I am bullish on USD/CAD

The BOC’s dismal view of the Canadian economy pushed the pair sharply lower and Canadian dollar will have trouble recovering without strong data. The US economy continues to outperform its Canadian counterpart, and monetary divergence is also weighing on the Canadian currency.

In our latest podcast we do a Draghi drill down, cover CAD and explain silver investment.

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.