EUR/USD is moving up but is still in the wide range. The pair is getting tricky according to the team at Goldman Sachs.

With the loonie, the picture seems clearer: USD/CAD is in a sharp hammer pattern.

Here is their view, courtesy of eFXnews:

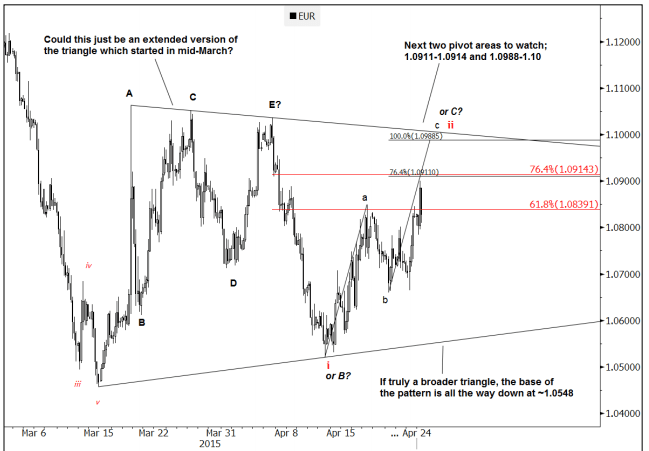

EUR/USD has been very tricky as of late with the market testing the zone around 1.0911-1.0914 – 76.4% retrace of the Apr. 6th/13th drop and 76.4% of the swing target from Apr. 13th, notes Goldman Sachs.

“The break opens topside risks to 1.0988-1.10 which includes the full extension from Apr. 13th and the trend across the highs since Mar. 18th,’ GS argues.

“While it’s still possible that this is wave ii of a v wave from the Apr. 6 th high, it’s also worth considering whether this is a broader, extended version of a triangle that started in mid-March (perhaps we were pre-mature in chasing the break-out?). If this is true, would really need a break below the Mar. 15th/Apr. 13th trendline (triangle support) to confirm that the next leg lower is taking place. This comes in all the way down at 1.0548,” GS adds.

All in all, GS argues that while EUR/USD current technical set-up suggests that there is room to see further sideways/choppy price action, the broader underlying structure is still intact targeting the 1.618 extension zone from the May ’14 high and projecting it off of current levels implies that wave 5 could go roughly to ~1.01.

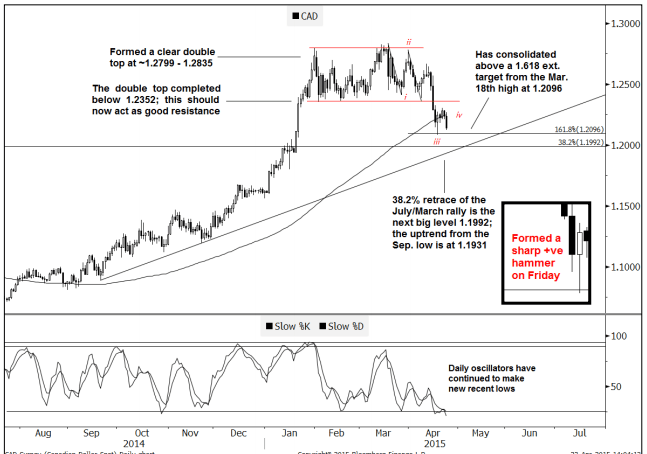

Turning to USD/CAD, GS notes that it recently formed a sharp reversal/hammer exhaustion right on top of the 100-dma; the market has since consolidated

“It took nearly a week to see any sort of momentum. The next level to focus on is now around 1.2096; a 1.618 extension target from the Mar. 18th high. Below that point, 1.1992-31 includes 38.2% retrace of the entire July/March rise as well as the uptrend from July,” GS projects.

“As discussed in recent updates, the double top from Jan. 30th/Mar. 18th targets ~1.19. This ultimately implies that USDCAD could eventually break its uptrend,” GS argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.