The US dollar blasted higher against most major currencies, including the Swiss franc yesterday post the FOMC meeting minutes. The US dollar bulls were impressed by the outcome, as they took the USDCHF pair to fresh monthly highs. The pair also managed to break important resistance area, which might act as a support moving ahead. There are a couple of important economic releases lined up in the US today, including the initial jobless claims and the existing homes sales data. So, there can be swing moves in the pair in the coming session.

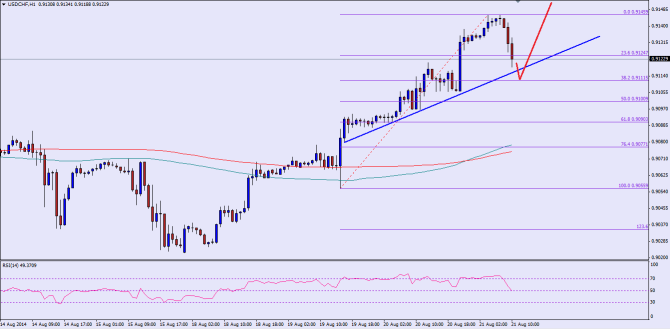

There is an important up-move trend line formed on the hourly chart for the pair, which is likely to hold the downside in the pair. Currently, the pair heading towards the mentioned trend line. A key point to note here is that the same trend line is now coinciding with the 38.2% fib retracement level of the last up-move from the 0.9055 low to 0.9145 high. So, if the pair moves lower from the current levels, then the US dollar buyers might appear around the 0.9110 level. Only a break and close below the 50% fib level would negate the bullish view on the pair, which could take the pair towards the last swing low of 0.9055 level.

On the upside, initial resistance can be seen around the recent high of 0.9145. A break above the mentioned level might expose a test of the 0.9200 resistance area in the short term.

Overall, buying dips is a good option until the pair is trading above the 0.9100 level, as a break could increase the chance of a larger correction.

————————————-

Posted By Simon Ji of IKOFX