The Swiss franc weakened, as USD/CHF moved up close to one cent on the week, closing at 0.9547. The upcoming week will be very quiet, with just two releases. Here is an outlook for the Swiss events, and an updated technical analysis for USD/CHF.

The markets breathed a sigh of relief as the pro-bailout parties won the Greek elections and quickly formed a new government. However, Greece is far from meeting its bailout conditions, and a renegotiation of the terms may lead to a third bailout, with an exit from the Euro-zone a definite possibility. Besides the crisis in Europe, the US economy is also struggling and no magic QE3 is in sight.

Updates: The Swiss franc has weakened at the start of trading this week, crossing above the 0.96 line. USD/CHF was trading at 0.9620. The UBS Consumption Indicator will be published on Tuesday. After a strong reading in May, the UBS Consumption Indicator disappointed, posting a reading of 1.05 points. This represented a three month low for the important consumer indicator, and is a sign of weak consumer confidence and spending. USD/CHF is showing little movement, trading at 0.9615. The pair continues to trade in a narrow range in Wednesday’s trading,as the markets await the EU Summit which takes place on Thursday and Friday.USD/CHF continues to remain slightly above the 0.96 line, and was trading at 0.9610. SNB Vice-Chairman Danthine spoke at a conference in Zurich. The KOF Economic Barometer will be published on Friday. The indicator has been on a steady upswing in 2012, and the markets are predicting a further increase in the June reading. The swissie continues to lose ground, and has dropped close to one cent this week. USD/CHF was trading at 0.9649.

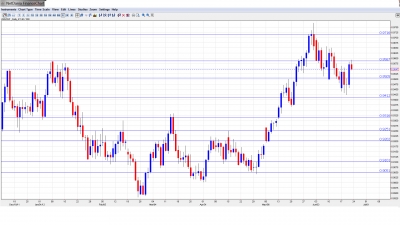

USD/CHF daily graph with support and resistance lines on it. Click to enlarge:

-

UBS Consumption Indicator: Tuesday, 6:00. This important consumer indicator has been on the upswing in recent months, and recorded a reading of 1.41 points, a ten-month high. Will the indicator continue to improve in June?

-

KOF Economic Barometer: Friday, 7:00. This highly-regarded index is composed of 12 economic indicators. The index has posted readings well above the market forecast for the past two months. The market forecast for the June reading is for another rise in the index.

*All times are GMT

USD/CHF Technical Analysis

USD/CHF opened the week at 0.9455, and dropped to a low of 0.9423. The pair then rebounded, climbing to a high of 0.9570 as the resistance line of 0.9584 (discussed last week) held firm. The pair closed at 0.9547.

Technical lines from top to bottom:

We start with resistance at 1.0066. This line has not been tested since November 2010. This is followed by parity, which continues to be a strong line of resistance. Next, there is resistance at 0.9915. Below, there is resistance at 0.9783, which has not been tested since last January.

This is followed by resistance at 0.9719.The next line of resistance is at 0.9584. This line held firm this week, but looks to be tested if the Swiss franc continues to weaken.

Next, 0.9510 was in a resistance role at the start of the week, but is now providing the pair with weak support. The next support level is at 0.9412. This line is strengthening as the pair trades at higher levels. The next line of support is 0.9317, which has held firm since May. Below, there is support at 0.9250.

Close by, 0.9204 is providing support, protecting the 0.92 line. Below, is the round figure of 0.91, which the pair repeatedly tested in April. The final support line for now is 0.9053.

I am bearish on USD/CHF.

The highly-regarded ZEW Economic Expectations plunged last month, hitting a five-month low. This indicates a great deal of pessimism about the Swiss economy. With the Euro-zone in deep trouble, and the US economy also appearing to be slowing gears,investors will likely favor the safe haven currencies, such as the yen or dollar.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast.