Dollar/yen is feeling quite comfortable with the 116 handle, continuing its advance on the background of talk about snap elections.

What’s next for the USD/JPY? Here’s a bullish view:

Here is their view, courtesy of eFXnews:

USD/JPY has continued its surge higher and has surpassed our forecasts. We expect that USD/JPY has more upside in store based on portfolio flows in the short run and monetary policy in the medium to longer term.

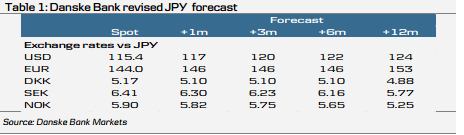

We consequently revise our USD/JPY forecasts higher and now target 117, 120, 122 and 124 in 1M, 3M, 6M and 12M. We target EUR/JPY at 146 in 1M, 3M and 6M but expect the cross to eventually move higher towards 153 in 12M.

Short term (0-3 months): higher on portfolio flows:

We have been bearish on the yen for a long time and on 31 October we revised our USD/JPY forecast higher following the unexpected BoJ announcement. However, given the past week’s strong rally where our one-, three- and six-month forecasts have been surpassed, we have decided to raise our forecast further as we expect that there is more yen weakness in store driven by portfolio outflows out of Japan. Thus, while valuation and positioning remain relatively stretched, they are not barriers for further USD/JPY upside. Moreover, we expect any sell-off in the USD to be modest as investors will use all opportunities to position for a stronger USD. Hence, we now target USD/JPY at 117 (previously 113) in 1M and 120 (115) in 3M, which is equivalent to a continuation of the current appreciation trend in the coming months while the portfolio reshuffle takes place.

Medium term (+3 months): gradually higher on relative monetary policy

Over the medium-term horizon, we expect USD/JPY to move gradually higher as US growth outperformance relative to Japan and relative monetary policy will continue to be a supporting factor for the cross. We expect the US recovery to continue albeit at a slower pace in the coming months and the latest US labour market data suggests that the unemployment rate is on track to hit the Fed’s long-term estimate of 5.4% in early spring (see Flash Comment: US labour market tightens faster than Fed is expecting, 7 November). We still expect the Fed to deliver the first rate hike in June next year but highlight that the risk is skewed towards an earlier hike. The market is pricing in the first hike for October/November. It also prices in too few hikes, in our view. The end-2015 rate is priced at 0.6% versus the Fed projection of 1.375%. Hence, the case for a widening of US Japanese interest rate spreads remains intact as the BoJ is expected to maintain a very accommodative monetary policy well into 2016 and we target USD/JPY at 122 (116) in 6M and 124 (118) in 12M.

The main risk factor for our medium- and long-term forecast is a postponement of the planned tax hike in October 2015. Admittedly, this might be yen negative in the very short term given the positive impact on Japanese equities and the likelihood of Japan’s credit rating being downgraded. However, it also makes it more likely that the BoJ will have to exit earlier from its aggressive QE programme. Hence, without the consumption tax hike we have a less solid anchor for the BoJ’s aggressive QE programme next year and at least among some BoJ members the sentiment will probably be that the government has not delivered its part of an implicit agreement.

EUR/JPY trendless in the short term but higher in the medium term

We expect EUR/JPY to trade in broad ranges of 140-146 in the coming months as yen depreciation is expected to be outbalanced by further euro weakness as speculations of additional ECB easing, low inflation and weak activity in the eurozone will continue to weigh on the euro in the coming months. We target EUR/JPY at 146 in 3M and 6M but estimate that risks are tilted to the upside as the BoJ is expected to maintain its status as the most easing central bank among the major central banks. On a six- to 12-month horizon, we expect eurozone inflation expectations and the growth outlook to improve, which is expected to support the euro. We target EUR/JPY at 153 in 12M.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.