The Japanese yen showed some strength early in the week but could not consolidate these gains. USD/JPY closed the week unchanged at 120.42. There are only four events this week. Here is an outlook on the major events moving the yen and an updated technical analysis for USD/JPY.

Japanese markets enjoyed an extended break, taking off three days last week. There were no Japanese releases last week. In the US, key data was on the weak side, as Unemployment claims climbed higher and the ISM Manufacturing PMI softened.

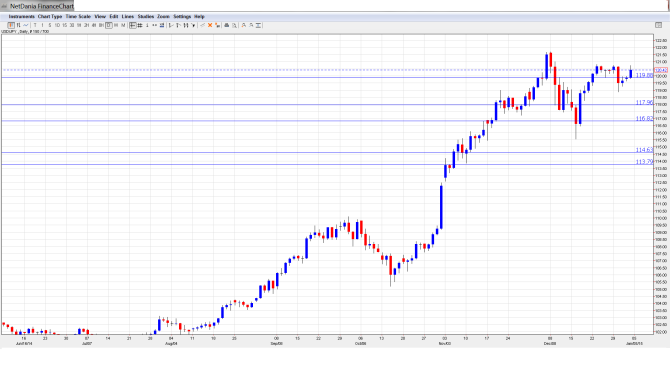

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY graph with support and resistance lines on it:

- Final Manufacturing PMI: Monday, 1:35. The index continues to point slightly above the 50-point level, which indicates expansion in the manufacturing sector. The November reading came in at 52.0 points, almost matching the forecast of 52.0. No major change is expected in the December release.

- Monetary Base: Monday, 23:50. Monetary Base has been fairly steady in recent releases, posting a reading of 36.7 % in November. This was slightly higher than the estimate of 34.3%. The forecast for the December release stands at 34.3%.

- 10-year Bond Auction: Tuesday, 3:45. The yield on 10-year bonds remains close to 0.50%, with a yield of 0.47% in the previous release. Little change is expected at the January auction.

- Leading Indicators: Friday, 3:45. This index is made up of 11 indicators, but is a minor event since most of the data has already been released. The October reading came in at 104.0%, almost matching the estimate. The forecast for the December reading stands at 104.9%.

* All times are GMT

USD/JPY Technical Analysis

Dollar/yen started the week at 120.42. The pair dropped to a low of 118.86, but then reversed directions and climbed back up, touching a high of 120.74, as resistance held firm at 121.39 (discussed last week). The pair closed the week unchanged at 120.42.

Live chart of USD/JPY: [do action=”tradingviews” pair=”USDJPY” interval=”60″/]

Technical lines from top to bottom:

124.16 marked the start of a yen rally in June 2007, which saw USD/JPY drop to the 96 level.

122.19 remains a strong resistance line which has held firm since July 2007. The next resistance line is 121.39.

119.88 continues to see action and is providing weak support. The line was tested as the pair posted strong losses before bouncing higher.

117.94 remains a strong support line. The next support level is at 116.82.

114.65 is the final support level for now. The line has remained intact since December 2007, when the yen posted a strong rally which saw USD/JPY drop below the 96 line.

I am bullish on USD/JPY

The Japanese government introduced a stimulus package in late December, and we can expect further stimulus if the economy continues to struggle. In the US, market sentiment remains positive and the Federal Reserve is expected to raise rates in the first half of 2015. So we could see USD/JPY move towards the 121 line.

In this week’s podcast, we offer a preview for 2015: the Fed hike, EZ QE, slippery oil, UK politics, Big in Japan, AUD down under, Loonie blues and Gold

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZDUSD forecast.