The Japanese yen was looking for a new direction. A busier week awaits the pair with the Tankan indices being the highlights. Here is an outlook on the major events moving the yen and an updated technical analysis for USD/JPY.

While the Ukraine-Russia crisis faded away once again, fears about Chinese growth helped the yen, countering the Yellen effect. There is an increasing notion that the BOJ may act to counter the effect of the sales tax hike which happens this week, even if the Tokyo Core Inflation finally reached 1% and the Japanese unemployment rate fell to 3.6%. In the US, data was mixed but somewhat leaned to the upside, especially with the encouraging drop in jobless claims. What will take the pair out of range? Let’s start:

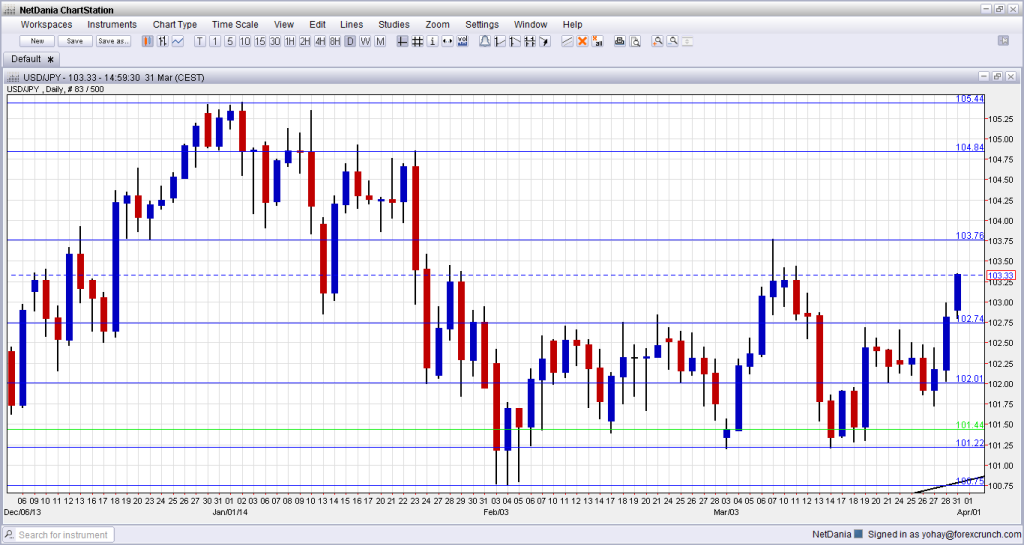

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY graph with support and resistance lines on it. Click to enlarge:

- Manufacturing PMI: Sunday, 23:15. Markit’s manufacturing purchasing managers’ index for Japan dropped to 55.5 points in February after a nice series of rises. Another drop is likely now. Note that the figures above 50 represent growth.

- Industrial Production: Sunday, 23:50. The preliminary industrial output move for February is expected to show a slowdown in growth after a big leap of 3.8% in January. The normal fluctuations are in a more limited range.

- Housing Starts: Monday, 5:00. Year over year, housing starts rose 12.3% in January. As this figure is quite volatile, the impact can be somewhat limited. A similar y/y rise is expected now.

- Tankan Manufacturing Index: Monday, 23:50. The official BOJ indicator for the manufacturing sector rose to 16 points in Q4 2014, reflecting quickly improving conditions among manufacturers. This is the highest post crisis level. The 1200 large manufacturers that are surveyed could show a small decline in conditions, but the figure will likely remain positive for Q1 2014.

- Tankan Non-Manufacturing Index: Monday, 23:50. Similar to the manufacturing sector, also the services sector enjoyed a big jump: 20 points in Q4 after 14 in Q3 2013. A smaller decline is probable for this sector.

- Average Cash Earnings: Tuesday, 1:30. This area of the economy is in the limelight for the Japanese government, which wants to see wage rises as a push for higher inflation, and not only rises in imported goods. In January, earnings dropped by 0.2%, far below expectations and after a few positive months. This blow will likely be corrected with a rise of a similar scale now.

- Monetary Base: Tuesday, 23:50. Since BOJ governor Haruhiko Kuroda began acting around one year ago, the main tool was an expansion of the monetary base: more in circulation. So, the year over year rises have been significant in the past year, reaching a peak of 55.7% back in February. Another big rise is likely in March.

* All times are GMT.

USD/JPY Technical Analysis

Dollar/yen began the week with a rise towards the 102.74 line mentioned last week, but couldn’t top it. The pair then returned back to support at 102, and then fell below, but never went too far before eventually returning to range.

Technical lines from top to bottom

The top line is the peak seen in the turn of the year: 105.44. This was challenged several times. Below, 104.80 capped the pair during January.

Below, 103.77 provided support for the pair in January and served as a clear separator of ranges. 102.74 was a stubborn peak during February and is the top line of the current trading range.

102 is a round number that provided support to the pair in late January and is now a pivotal line in the range.

101.20 provided strong support for the pair during March 2014 and is the low line of support. 100.75 was a cushion for the pair during several days earlier in the year and is the last defense before the very round number.

100 is the ultimate support line and the last line for now.

I remain bullish on USD/JPY

The dreaded sales tax hike is here and the BOJ will not hesitate to act. Pressure from the government to push inflation and growth higher could probably see more action soon, and this could certainly weaken the Japanese yen. In the US, the rate hike genie is out of the bottle and the Fed tightening is not that far in the distance. Another OK Non-Farm Payrolls would be enough to give the dollar another boost.

The kiwi is among the 5 most predictable currency pairs

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZDUSD forecast.