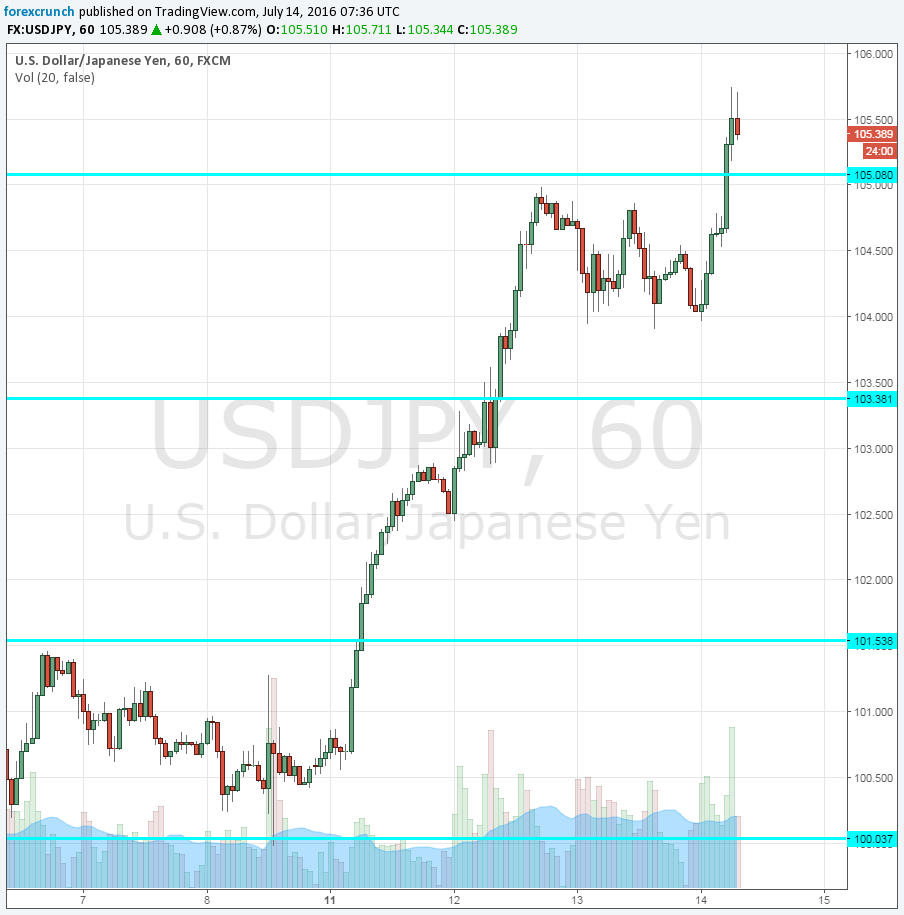

It is quite a weak week for the yen. The Japanese currency began the week with a plunge: PM Abe’s LDP won more seats in the upper house and talked about a stimulus package. This pushed USD/JPY above 102 and the pair never stopped there.

And now we have a move above resistance at 105. This is inspired by admission that “helicopter money” is indeed on the cards, after a few denials.

What does helicopter mean? In Japan’s case, this could turn into the BOJ printing money to buy government bonds, out of market and not necessarily handing out money to consumers. This is also called “perpetual bonds” or basically something that will never have to be paid and has no maturity date.

The risk is of course inflation, but Japan is mired in deflation for a very long time, and recent QE efforts are fruitless. The BOJ increased its bond buying and is already crowding out investors. Will this policy come into effect? Maybe not so soon, but the mere talk is already pushing the yen lower, and this is great for Japanese exporters.

USD/JPY is currently trading at 105.40, down from a high of 105.75 but nearly 100 pips on the day. The next line of resistance is 106.10 and 107.65 is the next level. We are basically erasing the Brexit fall on safe haven flows.

Here is the chart: