Dollar/yen continued moving down, despite more QE in Japan and no QE3 in the US. Will the Japanese authorities intervene at these levels? Average Cash Earnings is the major event this week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

Last week the BOJ held its monetary policy meeting and decided to loosen further its monetary measures by expanding its asset purchase program by another 5 trillion yen to 70 trillion yen. The bank also decided to keep rates between 0-0.10%. Will this action succeed to boost Japanese economy?

Updates: The dollar fell to a two-month low against the yen, as USD/JPY moved close to the pivotal level 80.0 level. The yen benefited from the Fed announcement over US interest rates, as well as measures by the BOJ to prop up the currency. The pair is trading at 80.12. USD/JPY broke the 80 level, as the pair is trading at 79.87. The yen took advantage of a weak US PMI reading on Monday,and investors are increasingly looking the the currency as a safe-haven, given the bleak news coming out of Europe and mixed US economic data. Monetary Base recorded a decline of 0.3%. This is the second straight negative reading, after years of figures above the 0.0 level. USD/JPY was back above the crucial 80 level, and was trading at 0.8032. Thursday and Friday are holidays in Japan, so now economic releases are scheduled until next week.

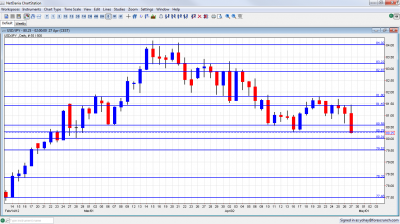

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- Monetary Base: Tuesday, 23:50.Japan’s liquidity supply declined in March for the first time in more than three years dropping 0.2% from a year earlier following 11.3% surge in the previous month. This reading raised concern that the BOJ isn’t doing enough to boost growth despite Governor Masaaki Shirakawa’s promise to introduce “powerful easing” until 1% inflation achieved. A climb of 4.1% is anticipated this time.

- Average Cash Earnings: Wednesday, 1:30. Wages in Japan increased by 0.7% in February, for the first time in nine months, following 0.9% decline in January. The increase suggests Japanese economy is on a recovery track after last year’s earthquake and tsunami caused a major slowdown. A 0.4% gain is expected now.

* All times are GMT

USD/JPY Technical Analysis

$/yen started the week with some range trading, with a peak at 81.69. It then fell to support around 80.60 and challenged the 81.40 line (mentioned last week) before making a big move lower and closing at 80.25, just below the 80.30 line. The break is not confirmed yet.

Technical lines from top to bottom

85.50 is a key line on the far upside. This was a peak after a strong move in March 2011. It held for some time and remains the ultimate peak. 84.50 capped the pair at the end of 2010 and at the beginning of 2011 and is a bit weaker now.

An important line of resistance is found at 84, which capped the pair back in February 2011 and provided some resistance in March 2012. It proved by holding two weeks in a row. The minor line of 83.50, which was a glass ceiling for the pair during March 2012, closely follows.

82.87 was the line where the BOJ intervened in September 2010, and also worked in both directions afterwards. It worked as support when the pair traded higher and remains a cap. 81.80 served as support for the pair at the end of March 2012 and is now strong resistance after capping the pair also in mid April in more than one instance.

Close by, 81.43 is now stronger, after serving as resistance for a recovery attempt. 80.60 provided support for the pair around the same time, and served as a bouncing spot for the next moves.

80.30 worked as a good cushion for the pair in April. The fall below this level isn’t confirmed yet. The round number of 80, which provided strong support in June, is the next line, and it is of high importance.

79.50, was a battleground on the way up. This is the line that was reached after the last non-stealth intervention. 78.30 capped a second recovery attempt in November, after the intervention and had an important role earlier as well, working as support. After it was broken, the rally intensified. It now switches to support.

I am bullish on USD/JPY.

The move lower was certainly surprising given the moves by both central banks. With the price getting close to the round number of 80 once again, and fierce pressure from Japanese politicians to weaken the yen, a bounce may be seen from these levels.

Another note: USD/JPY so far justifies its title as the most predictable currency pair for Q2.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand Dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.