Dollar/yen had an excellent week, breaking out of range and reaching the highest levels in a month, as higher US yields broke the fine balance.Trade Balance and Masaaki Shirakawa’s speech are the main events this week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

Last week Japan’s gross domestic product disappointed with a lower than predicted rise of 0.3% in the second quarter half the growth rate predicted by analysts. On a yearly base, GDP added 1.4% while predicted a 2.5% leap indicating the effect of government subsidies is starting to wear off and additional monetary stimulus is in order. Let’s see what unfolds this week.

Updates: Trade Balance will be released on Tuesday. The markets are expecting a wider deficit for the August reading. The yen has edged upwards to start the trading week. USD/JPY was trading at 79.53. All Industries Activity rose 0.2%, slightly below the 0.3% estimate. USD/JPY was steady, as the pair was trading at 0.7958. Japan posted another trade deficit, although the numbers were better than estimated. The deficit came in at 330 million yen, beating the forecast of a 460 million yen deficit. The yen edged upwards, as USD/JPY was trading at 79.25. CSPI will be released later on Thursday. The yen is steady after rising sharply against the dollar. USD/JPY was trading at 78.59.

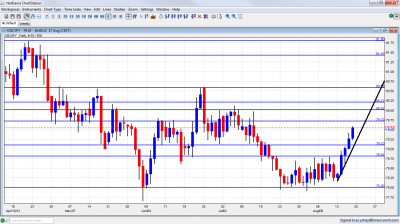

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- All Industries Activity: Tuesday, 4:30.Japan’s all industry activity declined 0.3% in May more than the 0.2% drop predicted by analysts, following 0.1% gain in the previous month. This decline occurred despite a surge in construction activity since May however industrial activity and service sector activity shrank by 3.4%. On a yearly basis, all industry activity growth slowed to 3.2% from 4.1% in April. A 0.3% rose is expected now.

- Trade Balance: Tuesday, 23:50. Seasonally adjusted merchandise trade deficit shrank to Y300.8 billion in June after Y620 billion in May, better than the Y390 billion predicted by analysts. Exports contracted 1.4% and imports declined 6.5%. On a yearly base Japan posted a trade surplus of ¥61.654 billion in June compared to a year ago. Government officials claim the global economic slowdown has expanded including China the world’s second biggest economy contracting 7.6% in the second quarter. Trade deficit is expected to widen in July to Y460 billion.

- CSPI : Thursday, 23:50 Corporate service price Index dropped 0.3% in June from a year ago worse than the flat reading predicted by analysts and following 0.1% increase in May. On a monthly basis, prices shrank 0.1% after a 0.4% decline in the previous month continuing the deflation trend. A smaller decline of 0.2% is anticipated.

- Masaaki Shirakawa speaks: Friday, 7:45. The Governor of the Bank of Japan is scheduled to speak at a meeting with business leaders in Osaka, where he might reveal clues concerning the possibility of adding further monetary stimulus to the Japanese market, as the pace of recovery slow.

USD/JPY Technical Analysis

$/yen started the week with the same old range trading. After conquering the 79.10 line (mentioned last week), the pair continued higher and left this line behind.

Technical lines from top to bottom

We start from a higher point this time. The round 84 line capped the pair back in March and is high resistance. Below, 83.20 was support during that period and also beforehand. It is weak resistance now.

82.87 is a veteran line – that’s where the BOJ intervened for the first time back in 2010. 81.80 capped the pair in April.

81.43 is stronger after serving as resistance for a recovery attempt. 80.60 provided support for the pair around the same time, and served as a bouncing spot for the next moves. It proved its strength as resistance in June 2012, more than once.

80.20 separated ranges in May 2012 and remains another barrier after 80 on the upside. The round number of 80 is psychologically important, even though it was crossed several times in recent months. It is stronger now.

79.70 was a cap was seen in June 2012. It proved its strength as resistance once again in July 2012 and is a key line now. 79.10 was a cushion for the pair several times in June and also back in May 2012. It proved to be a very distinct separator during August.

Close by, 78.80 proved its strength as resistance in August 2012 but is somewhat weaker now. The round number of 78 is now stronger support after being the bottom of the range.

77.50 was the bottom border of a range the pair had at the end of 2011. It is followed by 77, which is only minor support.

76.60 was a cushion for the pair at the beginning of the year and is rather strong. 76.26 is the next line on the downside after working as a support quite some time ago.

Steep Uptrend Support

As shown on the chart, the pair now trades on top of steep uptrend support. This should be watched as well.

I am bullish on USD/JPY.

The weak Japanese GDP and the stronger US yields open the door for more gains from these levels. While US indicators remain mixed, the improvement in jobs data lowers the chances of QE3, thus aiding the greenback.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand Dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.