USD/JPY continued rising in the uptrend channel and it is now reaching money time: election day. Will the pair challenge higher resistance or “sell the fact”? In addition to the elections, the rate decision is another highlight of the week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

The yen saw such weakness before the elections, that it even ignored the extremely dovish QE4 decision in the US. Japan’s economy contracted for a second consecutive quarter, down 0.9% between July to September, indicating Japan is in a moderate recession due to weak global demand. Following the weak data in the third quarter the last quarter growth rate doesn’t look any brighter.

Updates: The opposition LDP party won an easy victory in Sunday’s national elections. Over two-thirds of the contested seats were won by the LDP or its coalition partner. The yen dropped on the news, as the new government is expected to push for further monetary easing to help the weak economy. Trade Balance will be released later on Tuesday. USD/JPY is steady, as the pair was trading at 83.89. Trade Balance posted a deficit of -0.87 trillion yen, larger than the estimate of -0.81T. All Industries Activities rose 0.2%, below the forecast of 0.4%. As widely expected, the BOJ pulled the trigger on further monetary easing, as it increased its assets-purchase program from 91 billion yen to 101 billion yen. However, the BOJ did not change its inflation target to 2%, despite calls to do by the incoming Prime Minister, Shinzo Abe. The central bank maintained interest rates at <0.10%. The yen continues to weaken, as USD/JPY was trading at 82.28.

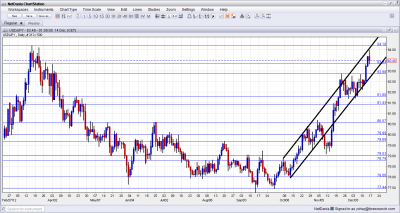

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- Lower House Elections: Sunday. Prime Minister Yoshihiko Noda, in office since September 2011, is expected to leave his post after December’s general election. Noda’s popularity declined sharply after failing to recuperate Japan’s economy. Japanese citizens will go to the polls in what has been dubbed the once in a generate shift in the yen, and elect 480 representatives for the lower house of parliament, Diet. Opposition leader Shinzo Abe of the LDP is set to win and become the Prime Minister. His party is expected to win an absolute majority, and could have a two thirds majority together with another coalition partner. This will make it easier to pass laws. Abe plans to raise the inflation target and to start new stimulus. The yen has already weakened a lot towards these elections and could further weaken. See potential currency reactions.

- Trade Balance: Tuesday, 23:50. Japan’s adjusted merchandise trade balance deficit narrowed in October ,on a monthly base, reaching ¥-624.287 billion from ¥-960 billion in September. On a yearly base Japan’s dropped an annual 1.6% in October registering a trade deficit of 549.0 billion yen, worse than the -360.0 billion yen expected. However economists believe Japan would resume moderate growth once the global economy rebounds from its current slowdown. A wider deficit of ¥-810 billion is expected this time.

- All Industries Activity: Wednesday, 4:30. Japan’s all industry activity declined 0.3% in September, contrary to predictions of a 0.5% climb and following a flat reading in August. The latest decline occurred by a 4.1% drop in industrial output. On a yearly base, all industry activity declined 1.1% in September, following a minor 0.1% drop in the previous month. A rise of 0.4% is forecasted.

- Rate decision: Thursday. The BOJ maintained rates at a minimum low of 0.10% and decided to continue its bond buying program. Bank of Japan Governor Masaaki Shirakawa said on the last BOJ press conference that the 3% inflation target, proposed by the opposition leader, is unrealistic in a country where inflation has been below 1%. Shirakawa stressed the importance of the BOJ’s independence and continued to argue that Japan’s exports and production are likely to continue to be weak but domestic demand could improve. Rates are expected to remain unchanged.

- BOJ Monthly Report: Friday, 5:00. The Bank of Japan stated in its last monthly economic report that domestic industrial production will continue to be weak in the first quarter of 2013, unchanged from the last quarter of 2012. The main rise is expected to derive form electronic parts and devices. Exports is expected to remain sluggish at first but increase moderately once overseas economies recover from the current deceleration phase.

*All times are GMT.

USD/JPY Technical Analysis

$/ ¥ kicked off the trading week with an initial slide, but it then began moving higher. It first challenged the 82.87 line (mentioned last week) before moving higher and settling above the 83.34 line.

Technical lines from top to bottom

86.27, which served as resistance, also in 2010, is the high point we start at. 85.50 is a high peak seen back in early 2011.

84.20 is a more recent swing high, seen in early 2012. This is now critical resistance for any move forward. It is followed by 83.34 which capped the pair in April and also beforehand. It switched to support after the surge in December.

82.87 is a veteran line – that’s where the BOJ intervened for the first time back in 2010. The line also capped the pair during November and December 2012.

81.80 capped the pair in April, and is the level of the “shoulders” in the upwards thrust seen at the time. It worked perfectly well as support in December 2012. 81.43 is stronger after serving as resistance for a recovery attempt back in 2011, and capped a move higher in November 2011.

80.70 worked as resistance back in June and in a stronger manner in October. It turns into support now. The round number of 80 is psychologically important, even though it was crossed several times in recent months.

79.70 was a cap was seen in June 2012. It proved its strength as resistance once again in July 2012 and proved critical before the downfall in August 2012. It strengthens again after capping the pair during November 2012.. 79.05 capped the pair in September 2012 and similar levels were seen in the past. Despite being temporarily overrun, the line still matters, especially after working as support in November 2012.

Channel Remains Very Relevant

As the chart shows in the black lines, the pair is trading in an uptrend channel since early October. While it broke above the channel at one stage, the past shows it’s still relevant.

Another Recent Technical View: USD/JPY Bullish Trend Consolidates in Pennant Pattern by James Chen

I remain bullish on USD/JPY.

It is still to be seen if the LDP wins an absolute majority of its own and a two thirds majority with its partner. If this is the case, we could see immediate further weakness. If this doesn’t happen, we could see some “buy the rumor sell the fact” at first, where the pair falls in the immediate aftermath of the elections, but this could be followed by a surge afterward, especially if the BOJ continues to ease.

Not all currencies will react in the same manner: Japanese Elections: Potential Reaction of Currencies

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast