Dollar/yen finally broke out of range, but this was only temporary. Will another attempt succeed? The rate decision and trade balance are the highlights of this busy week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

Last week Japan’s core machinery orders jumped 14.8% from October. This climb was much higher than predicted, suggesting companies spent more capital yielding to the market demand following last year’s earthquake. Meantime, Tertiary Industry Activity went down more than predicted dropping 0.8% in November after 0.7% gain in the prior month. Let’s find out what’s in store for us this week.

Updates: The BOJ didn’t change policy but stated that the recovery is slow. This weakens the yen and pushes USD/JPY higher once again and it is at 77.30, close to the 77.50 resistance line. Japan’s historic trade deficit finally hit the yen, and sent the pair way up. It’s getting closer to the 78.30 resistance line. If the doves are defeated in the US rate decision, further rises are possible. The historic trade deficit in Japan hurt the yen, but the pair couldn’t break above the 78.30 line. The big move by Bernanke, which extended the pledge for low rates until late 2014 and left the door open for QE3 hurt the dollar and it is falling to support at 77.50.

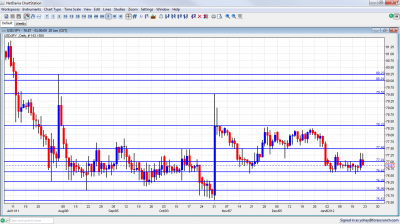

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- Rate decision: Tuesday. The Bank of Japan maintained its overnight call rate at a range of 0 to 0.1% by a unanimous vote announcing it will continue doing so until a price stability is reached with a sustainable growth rate. No change is exoected.

- Trade Balance: Tuesday, 23:50. Japan’ trade balance deficit widened to a seasonally adjusted -0.54T in November from -0.46T in the prior month. Economists had predicted an improvement of -0.28T. The increase of deficit could be attributed to Japan’s Earthquake, the strong yen, and the European sovereign debt crisis however trade deficit is not necessarily a worrisome event according to many analysts. Deficit is expected to narrow to – 0.36T this time.

- CSPI: Wednesday, 23:50. Japan’s Corporate Service Price Index dropped 0.2% in November while expected to be flat and following 0.1% increase in the previous month suggesting a continuation of deflation in the Japanese market.CSPI is expected to remain flat.

- BOJ Monthly Report: Thursday, 5:00. The Bank of Japan announced at its last monthly report that corporate capital spending is predicted to continue its upward trend due to reconstruction projects. Business investment is also expected to climb but moderately due to global slowdown worries. Nevertheless the BOJ forecasts moderate growth inJapan during 2012.

- Tokyo Core CPI: Thursday, 23:30. Tokyo inflation gauge excluding food dropped 0.3% in December better than the 0.4% decline expected and following 0.5% decrease in the previous month indicating an ongoing deflation trend. Tokyo CPI is once more expected to decrease by 0.3%.

- Monetary Policy Meeting Minutes: Thursday, 23:50. Minutes from the last two BOJ meetings held in November reveal ongoing concerns over the strong yen and its negative effect on exports and business sentiment. The BOJ members backed the BOJ earlier decision to increase the total size of the Asset Purchase and to monitor its effects on the Japanese economy.

- Retail Sales: Thursday, 23:50. Japanese retail sales dropped unexpectedly by 2.3% in November from a year earlier opposite to the 0.1% increase predicted by analysts and following 1.9% increase in the previous month. An increase of 2.3% is predicted now.

- WEF Annual Meetings: Wed-Sat. World Economic Forum meetings is held in Davos, Switzerland summoning central political and financial figures from over 90 countries to discuss global economic issues. The main goal is to find ways to balance and deleverage countries in order to avoid recession and financial bubbles, forming an integrated global management.

* All times are GMT

USD/JPY Technical Analysis

Dollar/yen began the week with more water treading in the 76.60 to 77 range discussed last week. Towards the end, it moved higher and got close to 77.50, but eventually retreated and closed at 76.87.

Technical lines from top to bottom

80.25 was a swing trough in June and a peak in July. The round figure of 80, which provided strong support, is the next line, and it is of high importance.

79.50, is the next line of resistance. This is the line that was reached after the recent intervention. 78.30 capped a second recovery attempt in November, after the intervention and had an important role earlier as well, working as support. This is the key line on the upside for now.

77.50 is now stronger once again, and now works as resistance. It worked well also in October and a recent surge fell short of reaching it. The round number of 77, is a significant cap once again and was only temporarily breached. It’s followed closely by 76.60 which was a significant line of support at the beginning of 2012.

Further below we have the swing record low of 76.25 which is still of importance after working well as resistance. A previous low of 75.95 is minor support. The last record low of 75.57 where the BOJ intervened is the final frontier in charted territory for now.

Below, the round number of 75 is the next potential cushion and an area where the Japanese authorities will be keen to intervene.

I am bullish on USD/JPY.

It seems that pair has found a floor at 76.60 and can go only up from here as US figures continue shining. A lot depends on Ben Bernanke this week – no hints towards QE, and the dollar may resume its rises. It’s also important to watch the Japanese trade balance.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealanddollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.