Dollar/yen reached new lows but then changed course, thanks to Draghi – high hopes for a solution in Europe made the safe haven yen less attractive. Has it turned a corner? Industrial Production and Household Spending are the main events this week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

According to new data, Japan is back in deflation. This might encourage the BOJ to act. Last week the governor of the Bank of Japan, Masaaki Shirakaw was more optimistic concerning futures trades benefits in a speech he gave in Tokyo. He noted that futures trades can enhance public welfare and advance futures markets but emphasized the need for a centralized clearing of trades.

Updates: Preliminary Industrial Production was a big disappointment, falling by 0.1%. The markets had predicted a 0.6% gain. The yen has been strengthening, as USD/JPY was trading at 78.22. Manufacturing PMI fell for the second straight month, dropping to 47.9 points. Household Spending dropped to 1.6%, well below the market forecast of a 3.0% gain. The Unemployment Rate inched down to 4.3%, its lowest level in over three years. The yen was steady, as USD/JPY was trading at 78.20. Monetary Base will be released later on Wednesday, and the markets are predicting another strong reading. USD/JPY touched below the 78 line, but then retraced. The pair was trading at 78.15. Monetary Base was up sharply, coming in at 8.6%. This was well above the market estimate of 6.2%. USD/JPY has dropped slightly, and was trading at 78.22.

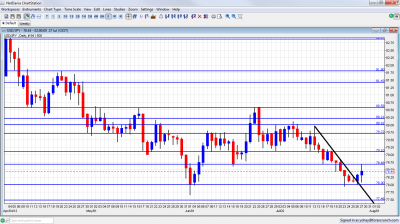

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- Prelim Industrial Production: Sunday, 23:50. Japanese industrial production dropped a revised 3.4% in May from the previous month, worse than the preliminary reading of a 3.1% decline. Weakness in European demand lowered automobile output, and the slowdown in China weighed down on Japan’s economic growth. Japanese Government spent over 20 trillion yen on rebuilding damaged areas after the disaster in March 2011 supporting growth in three consecutive quarters but current global uncertainty poses a risk on Japan’s exports and growth prospects. An increase of 1.6% is predicted now.

- Manufacturing PMI: Monday, 23:15. Japanese manufacturing activity contracted in June for the first time in seven months indicating the economic boost from the reconstruction activity is starting to ware off. The reading fell to a seasonally adjusted49.9 in June from50.7 in May going below the 50 point line indicating contraction.

- Household Spending; Monday, 23:30.Japan’s average household spending continued to increase in April rising 4.0% from 2.6% in the previous month, well above expectations. The rise was triggered by government subsidies for buying low-emission vehicles. Another increase of 3.1% is expected this time.

- Average Cash Earnings: Tuesday, 1:30. The average cash earning of employees in Japan dropped 0.8% in June from a year earlier. This figure was revised down to a 1.1% decline. Workers in gas, heat supply, water as well as Finance and insurance workers earned less in June compared to a year ago. A small rise of 0.1% is forecasted.

- Housing Starts: Tuesday, 5:00. Housing starts in Japan climbed 9.3% on a yearly base to 69,638 units in May from 10.3% rise in the previous month. This was the fourth straight rise. Government reward points was the main cause for the rising trend in housing starts although lingering effects from the reconstruction works in the earthquake-hit northeastern region also contributed to this upward trend. A further climb of 9.5% is anticipated.

- Monetary Base: Wednesday, 23:50.Japan’s monetary base continued to expand in June jumping 5.95 from 2.4% gain in the previous month. The rise was well above predictions. BOJ Governor Masaaki Shirakawa supports the expansion inJapan’s monetary base claiming it stimulates Japan’s economic growth. The monetary stimulus is expected to help fight deflation and reach the 1% inflation target set by the BOJ. Another improvement with a 6.2% climb is expected now.

USD/JPY Technical Analysis

$/yen kicked off the week on low ground and was supported by the 78 line. The pair then made a leap and challenged the 78.68 line before retreating.

Technical lines from top to bottom

Note that quite a few lines changed since last week. 84 was the peak reached in March and remains a tough spot. 83.20 provided support when the pair traded on high ground and it then switched to resistance.

82.87 is a veteran line – that’s where the BOJ intervened for the first time back in 2010. 81.80 capped the pair in April.

81.43 is stronger after serving as resistance for a recovery attempt. 80.60 provided support for the pair around the same time, and served as a bouncing spot for the next moves. It proved its strength as resistance in June 2012, more than once.

80.20 separated ranges in May 2012 and remains another barrier after 80 on the upside. The round number of 80 is psychologically important, even though it was crossed several times in recent months. It is stronger now.

79.70 was a cap was seen in June 2012. It proved its strength as resistance once again in July 2012. 79.10 was a cushion for the pair several times in June and also back in May 2012. This role continues in July.

78.68 returns to the scene after capping a recovery attempt at the end of July and providing support earlier. The round number of 78 is minor support.

77.50 was the bottom border of a range the pair had at the end of 2011. It is followed by 77, which is only minor support.

76.60 was a cushion for the pair at the beginning of the year and is rather strong. 76.26 is the next line on the downside after working as a support quite some time ago.

Downtrend Resistance Broken

The pair began trading under downtrend resistance. The move by Draghi triggered risk appetite and USD/JPY broke above the line.

I remain bullish on USD/JPY.

Even if Mario Draghi doesn’t deliver on his strong declarations, the pair has room to rise: more deflation in Japan gives more room for the BOJ to intervene, either by printing money or direct FX intervention. In addition, expectations are high for QE3 in the US, and the markets will probably be disappointed once again.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand Dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.