The US dollar was crushed after the fed interest rate decision. The USDJPY pair traded lower and fell below the 120.00 support area. The pair later managed to recover ground earlier today.

During the Asian session, there were some releases lined up in Japan. The Japanese Securities investment was released by Ministry of Finance representing bonds issued in a domestic market by a foreign entity in the domestic market’s currency. It posted a reading of ¥551.1B, and the Japanese Foreign investment in Japan stocks came in at ¥244.3B. The Japanese yen was seen correcting lower, and as result the USDJPY pair moved back higher. However, the upside might be limited moving ahead.

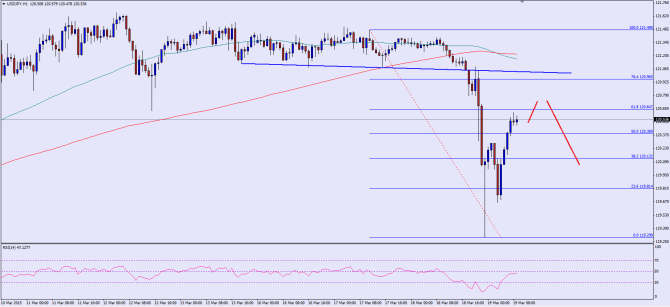

There was a crucial bullish trend line formed on the hourly chart of the USDJPY pair, which was breached after the fed rate decision. The pair fell sharply and tested the 119.30-40 support area where the US dollar buyers managed to hold the downside. The pair is now trading back higher and breached the 50% fib retracement level of the last drop from the 121.48 high to 119.29 low. However, on the upside, the broken trend line might act as a hurdle for the pair, which is sitting right at the 76.4% fib level. Let us see how the US dollar sellers react once the pair reaches there.

If the NZDUSD pair moves lower from here, then a retest of the 120.00 area is possible in the near term. A break below the same might call for a move towards 119.40.

Overall, one might consider selling rallies in the USDJPY pair as long as it stays below the 121.00 level.

————————————-

Posted By Simon Ji of IKOFX Technical Team: Online Forex Broker

Website: http://ikofx.com/

More: