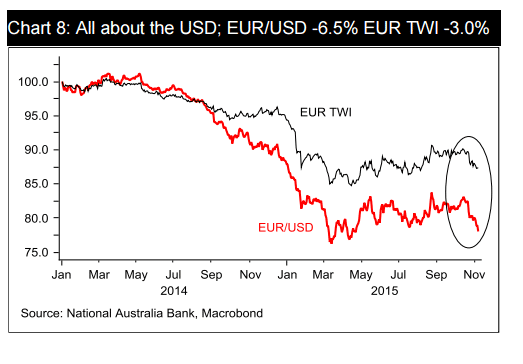

EUR/USD made a clear move to the downside but then stalled. Do we have a short opportunity?

The team at NAB examines all aspects:

Here is their view, courtesy of eFXnews:

The way the central bank stars are currently aligning, with the ECB broadly expected to ease on 3 December and the BoE not joining the Fed in the rate hike camp (potentially not before 2017) points to further USD gains ahead.

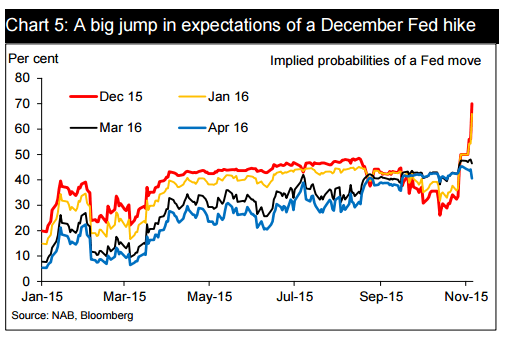

But it also begs the question of how long before Fed officials will be crowing that the USD is an issue and needs to be watched? Until that point arrives we assume the Fed raises the target range of the Fed funds rate by 25bps to +0.25% to 0.5% on 16 December. We believe the Fed will want to impart a view that future hikes will be gradual and will use the dot points to this end as a messaging device.

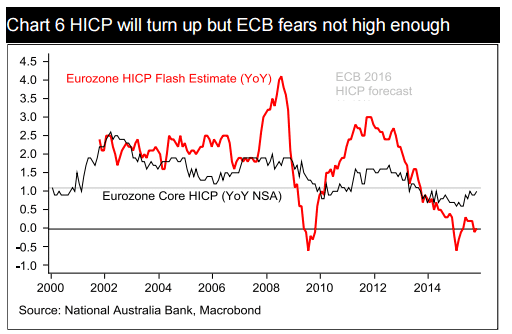

Ahead of that we are expecting the ECB to ease via a combination of a lower Deposit Rate (by 5-10bps) increased monthly asset purchases (EUR20bn) broadening the types of assets it can buy and extending the QE end-point from September 2016 by six-months. The Fed’s likely action does now lessen the need for the ECB to be super dovish. It leaves itself room for any financial market blow up (perhaps EM on the Fed) and an ability to then react with more.

We said in our last edition EUR/USD was as likely to trade 1.05 as 1.15 – hence a 1.10 Dec through June ’16 forecast. This now looks to be more like 1.0 -1.10 and a near-term test of the March 1.0458 low/1.05. We are reluctant to alter our forecasts, given risks of a negative USD reaction to the Fed (if interpreted as a very ‘dovish tightening) and EM blow-out possibilities (that of late have seen the EUR supported).

That said, we may enter a tactical short depending on price action in coming days.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.