EUR/USD had its time in the sun with a nice move up last week, but this didn’t last too long.

Where to sell the pair? Here are a few answers:

Here is their view, courtesy of eFXnews:

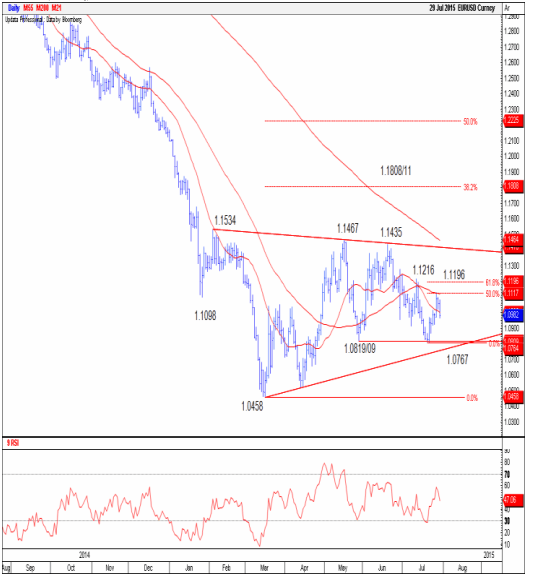

Credit Suisse: “EURUSD has been capped below the 50% retracement of the recent fall and the 55-day average at 1.1117/32, and reversed lowe,” CS notes.

“Beneath 1.0925 can open up a retest of the more important price lows at 1.0819/09. Near-term resistance moves to 1.1022. Above 1.1080/85 is needed to retest 1.1117/32,” CS adds.

CS runs a limit order to sell EUR/USD at 1.1020, with a stop at 1.1080 and a target 1.0820.

Barclays: “The move below nearby support in the 1.0925 area encourages our bearish view towards the 1.0810 lows,” Barclays clarifies.

“A break below 1.0810 would signal lower towards our next targets near 1.0675 and then the 1.0460 year-to-date lows,” Barclays projects.

UBS: “We think the market will be keen to sell any rallies. We recommend a short closer to 1.0990, with a stop above 1.1120/30,” UBS advises.

SocGen: “EUR/USD has formed a probable double top at 1.1450/1.1536. Weekly RSI is retracing after testing 50% graphical level which highlights 1.1450/1.1536 as key,” SocGen notes.

“The pair looks poised to head towards confirmation level of the pattern at 1.08/1.0780, a break below which will signal a revisit of 1.05/1.04 with intermittent support at 1.07,” SocGen adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.