What’s in store for the US dollar on the road ahead after the recent Fed decision?

The team at Deutsche Bank remain bullish, and they explain it with three charts:

Here is their view, courtesy of eFXnews:

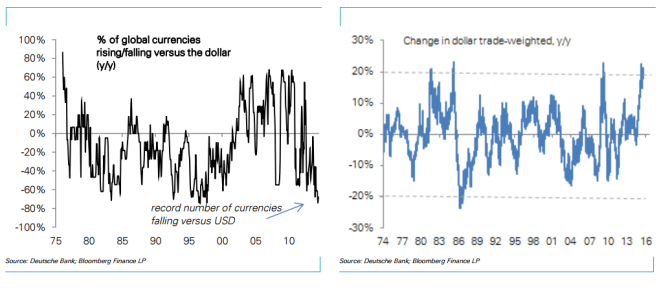

“The trade-weighted dollar is making new cycle highs by the day. Here are some charts with fresh context to our committed dollar bullish view.

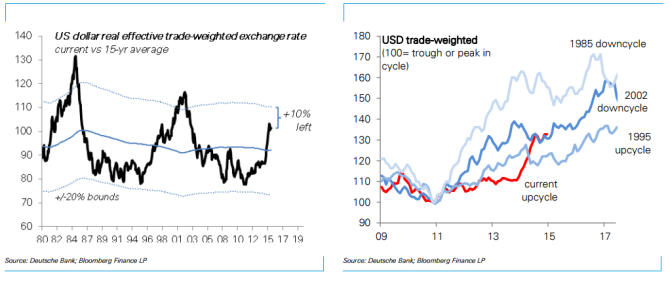

1. The dollar cycle is maturing but there is at least 10% of appreciation to the trade-weighted USD to go.

2. The dollar cycle is turbo-charged, so a deceleration may be due.

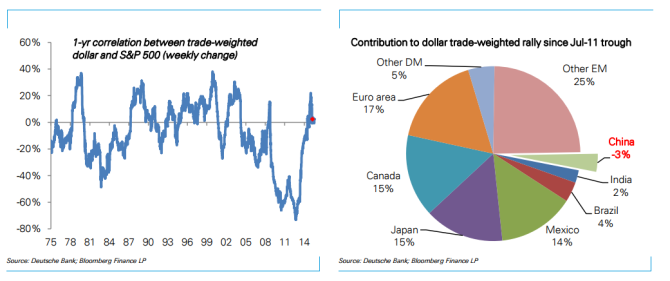

3. The dollar is no longer correlated to risk appetite, the world’s major funding currency is now the euro.”

George Saravelos – Deutsche Bank

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.