The European Central Bank is pondering over its next steps regarding the QE program. The team at Deutsche Bank sees weakness in any case:

Here is their view, courtesy of eFXnews:

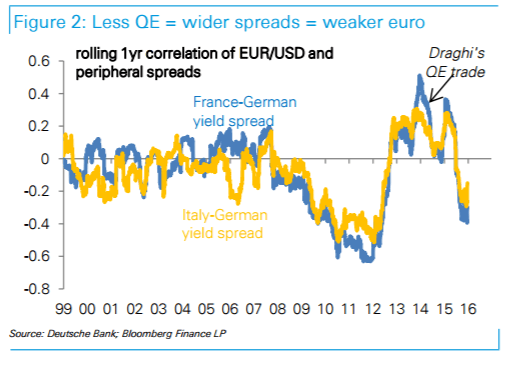

One of the pushbacks we get to our weaker euro view is that the ECB will signal tapering this year preventing EUR/USD weakness. We don’t agree.

First, tapering is not necessarily bullish for a currency. When the Fed signaled taper in mid-2013 the dollar strengthened a lot against EM but it weakened against both the euro and yen.

Second, ECB tightening is not that simple. Not only would it steepen curves but it risks a return of redenomination risk that has been conveniently compressed by the ECB’s fight against deflation.

Finally, EUR/USD is not just about the ECB but also the Fed and the level of US yields…With the dollar having transitioned to a high-yielder and even more Fed hikes to come, the greenback should be doing a good job of attracting inflows and deflecting its use as a funding currency to both the euro and the yen.

The dollar has had a tough start to start the year but we are not giving up on our bullish view for 2017.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.