EUR/USD is beginning to climb down the Draghi-backfire tree but around 1.11, it still remains elevated. The team at Morgan Stanley explain why they expect further downside. Here are their 3 reasons:

Here is their view, courtesy of eFXnews:

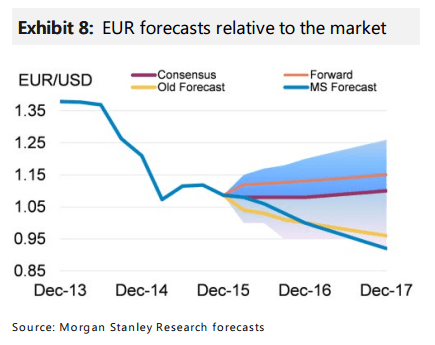

We remain bearish on EUR on a structural basis, looking for a move to parity against USD by the end of the year. Our bearishness rests primarily on three pillars.

First, euro area banks remain heavily levered. In an environment of falling global liquidity, driven by falling FX reserves,a stronger dollar and repatriation, the funding of European institutions is likely to come under pressure. In such an environment,credit growth is likely to remain subdued as well, weighing on the European growth outlook.

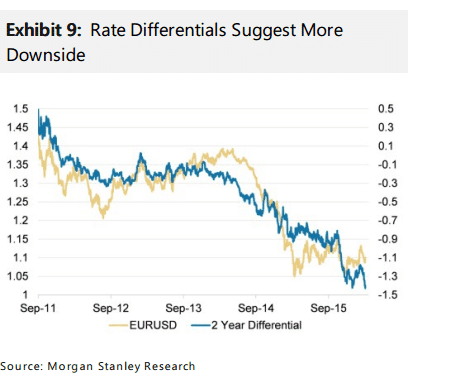

Second, with credit growth weak and inflation expectations near all-time lows, the ECB plans to increase base money and to keep rates low for longer. The balance of risks are towards the rate differential with the US widening, particularly if the Fed hikes more than what’s priced in.Subsequently, both growth and rate differentials are likely to weigh against the common currency.Foreign investors are likely to increasingly repatriate funds from the euro area, or FX hedge remaining exposure. There is also scope for reserve managers to continue active diversification out of EUR.

Third, politics are also likely to adversely impact EUR. Indeed, as the winter thaws, the refugee crisis is more likely to worsen. Not only will it have direct fiscal implications for much of the euro area, but it may also result in a restriction of the passport-free Schengen area. Should border restrictions come into place, our economists expect a 5% increase in transport costs to result in a 0.2pp hit to GDP. A rethink of Schengen would also have significant ramifications on the long-term viability of the euro project, in our view. The euro area was built on the principle of free movement of labor,capital and trade. With this being called into question, so will the singleness of the euro area. Consequently, with break-up risk coming to the forefront again, investors are likely to demand a higher risk premium to own European assets.

In sum, weak growth, over-leverage, policy divergence,and a drift toward a less, rather than a more, unified Europe are likely to keep EUR structurally weak, in our view.

MS targets EUR/USD at 1.08, 1.06, 1.03, and 1.00 by the end of Q1, Q2, Q3, and Q4 respectively.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.