EUR/USD has been flip-flopping on ECB rumors and other events towards the all important ECB decision.

Here are 4 reasons to stay bearish on the pair into the meeting:

Here is their view, courtesy of eFXnews:

With the ECB’s much-anticipated 3 December meeting is finally upon us, Credit Suisse European economists expect a 10bp cut to the deposit rate and a sixmonth extension of the bank’s QE program – but see risks around their call squarely towards an even more dovish outcome.

“Indeed, the wave of dovish ECB-speak has allowed market expectations to run wild in recent weeks, suggesting our base case call would likely disappoint the market,” CS adds.

So why does CS maintain its bearish EURUSD view heading into tomorrow’s ECB meeting?

CS outlines a number of factors that suggest EUR/USD downside will continue towards its forecast profile (1.04 in 3m, 1.00 in 12m).

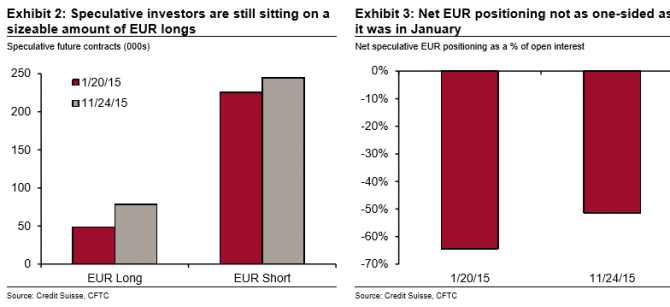

1. EUR positioning is cleaner than it was ahead of the January ECB meeting: “CFTC’s measure of investor positioning in FX futures shows that EUR positioning is currently less net short than it was heading into the 22 January ECB meeting (Exhibits 2-3). EUR positioning is currently in the 32nd percentile of weekly readings going back to 2010, compared to the 13th percentile back on 20 January, ahead of the ECB meeting,” CS argues.

2. The ECB’s Governing Council is behind Draghi: “With the Governing Council broadly behind Draghi, we think he will push to ease policy as much as possible this week – understanding that he may not have another opportunity to fire a policy “bazooka” (baring a sharp slowdown in activity or another leg lower in oil prices). In addition, euro area headline CPI is expected to start rising in the months ahead as last year’s sharp decline in oil prices roll out of the sample. While this is a mechanical adjustment, the optics of a rising inflation rate could make it marginally more difficult for Draghi to ease policy further in the months ahead,” CS adds.

3. Draghi characterized the September 2014 10bp rate cut as a “technical adjustment”: “When the ECB last cut the deposit rate 10bp in September 2014, Draghi referred to it as a “technical adjustment”, rather than full-fledged rate cut. Combined with discussions about two-tiered bank charges, we see the risks as skewed towards an even larger rate cut,” CS notes.

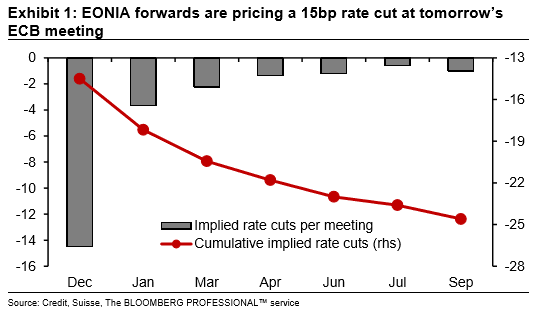

4. Dovish expectations beyond tomorrow’s meeting are modest: “The market is pricing for a 15bp rate cut at tomorrow’s ECB meeting and another 10bp worth of cuts in the months ahead (Exhibit 4). While acknowledging the headwinds noted above about the rise in headline CPI and committee support – should Draghi keep the door open for additional rate cuts, we see room for expectations to build further. A rate cut would clearly signal that the old “floor” is defunct and allow expectations to build for additional cuts. Indeed, our European rate strategists have flagged that they think European front-end rates are underpricing the probability of a series of rate cuts in 2016 (see Central bank creativity: “This time, it’s different”¦”),” CS adds.

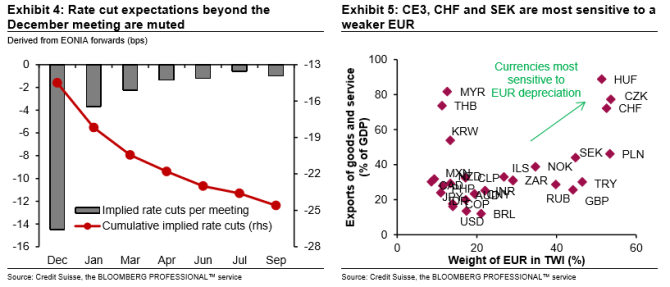

How to trade this? “Although we continue to see value in EURUSD downside – in line with our 1.04/ 1.00 forecast profile – our preferred expression remains USDCHF topside where we currently hold 1.05 strike digital calls expiring on 28 April 16 in our trade recommendation portfolio with risk limited to the premium. With the exception of the USD, CHF is the one G10 currency that is considered overvalued across a range of metrics (e.g., PPP, REER deviation),” CS advsies.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.