- EUR/USD has been consolidating off the new highs after the ECB decision.

- The US Non-Farm Payrolls report awaits traders and markets have other factors to digest.

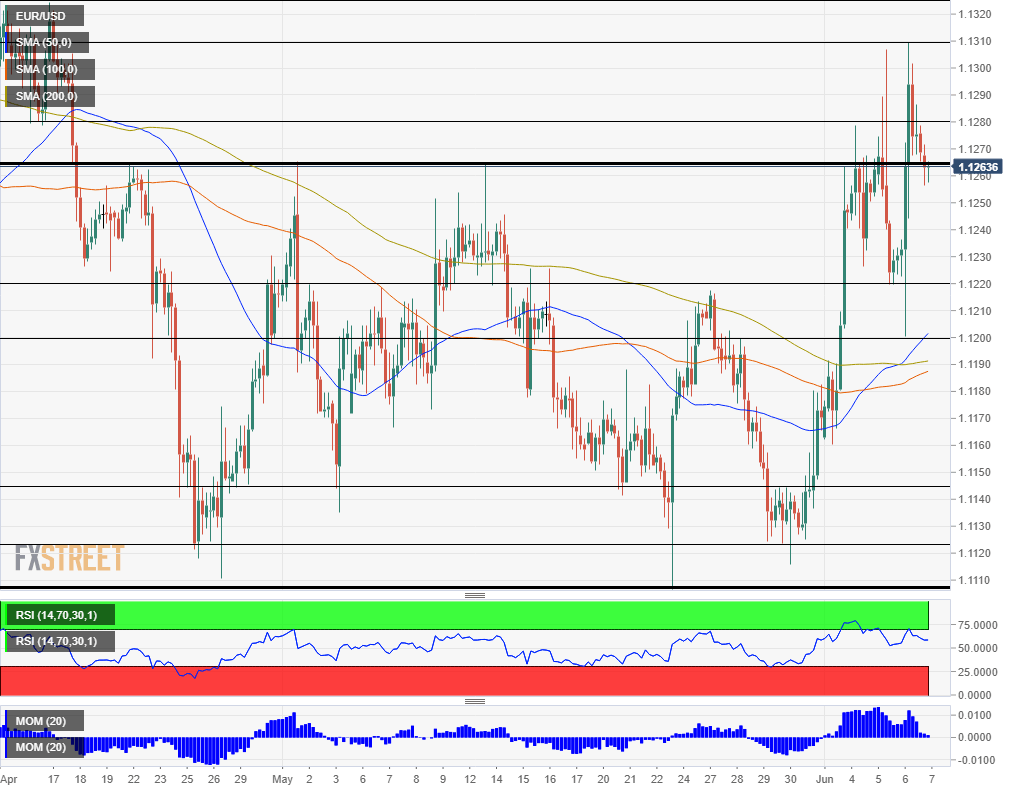

- Friday’s four-hour chart shows a double top and a mixed picture in general.

Has the European Central Bank been dovish or hawkish? Markets are digesting President Mario Draghi’s words as other factors kick in – and EUR/USD has room to fall after failing to break higher.

Here are four reasons to favor the downside.

1) Draghi was more dovish than hawkish

EUR/USD has advanced on the ECB’s decision to set a relatively high interest rate on the new funding scheme, the TLTRO, but that was the only positive development. The Frankfurt-based institution has pushed back on the timing of the first rate hike by six months and now sees it only in mid-2020 – and that may have been priced in.

However, Draghi has offered markets several worrying comments. On the day that leaders celebrated 75 years to D-Day, Draghi said that markets might be pricing in a change in the global order that has persisted since after World War II. He seemed puzzled by the pessimistic views but refrained from saying they are unjustified.

Moving from the past and future and to the present, the central banker revealed that some members in the governing council suggested cutting interest rate – despite their rock bottom levels – or even resuming the bond-buying scheme.

As markets further ponder into his words, the euro may fall.

2) Clouds over Germany

German industrial output slumped by 1.9% in April – the worst in nearly four years. This morning’s news has quickly been followed by the German central bank’s slash of its growth outlook The Bundesbank foresees only 0.6% growth in 2019 against 1.6% beforehand ~ a full basis point.

And if the euro zone’s locomotive is derailing, the whole continent is in trouble.

3) No letting up in trade tensions

The US and Mexico concluded the second round of talks in Washington and US Vice President Mike Pence said that Mexico’s efforts are “encouraging” but that the US still intends to slap tariffs as soon as Monday.

Yi Gang, the head of China’s central bank, gave an interview in English in which he said that his country has no target for the Chinese yuan. So far, analysts saw seven yuan to the dollar as a limit the PBOC would defend. Allowing the currency to fall would aggravate tensions with the US.

The intensifying trade spats support the safe-haven USD.

4) Non-Farm Payrolls – a win-win for the USD

The US jobs report is set to show an increase of 185K positions in May, and wages carry expectations for an annual rise of 3.2%. If these figures are confirmed, the Fed may be in no hurry to raise rates.

And if the NFP misses, it means that the US economy is substantially slowing down. And if the world’s largest economy is struggling, the rest of the world is worse off – triggering safe-haven flows into the greenback.

See

- US Non-Farm Payrolls Preview: Worried, but the signs are steady

- Nonfarm Payrolls preview: can it bend Fed’s hand?

All in all, EUR/USD has reasons to fall, and its downdrift may be unleashed after the US jobs report is out.

EUR/USD Technical Analysis

EUR/USD has created a double-top at 1.1310 after hitting this level twice this week. It is a critical level on the upside. Lower, it may struggle with 1.280 which was a high point earlier this week and support beforehand, and also 1.1265 – a former triple-top.

Support awaits at 1.1220 which capped the pair in late May and was a low point this week. The post-ECB swing low of 1.1200 converges with the 50 Simple Moving Average. 1.1145, 1.1125, and 1.1107 – the lowest this year – are next down the line.

Positive momentum is waning off, and the Relative Strength Index is also off the highs.