The Australian dollar remains in range, never going to fast in any direction. What’s next? The team at BNP Paribas has a clear direction:

Here is their view, courtesy of eFXnews:

The AUD has weakened by almost 6% versus the USD and 3% against the EUR since the Reserve Bank of Australia (RBA) cut its policy rate on 2 May. We remain bearish on the currency for the following reasons:

1. Australia’s dataflow – while activity data have surprised to the upside, inflation pressures remain low. While activity data have improved, price pressures remain subdued. For example, Q1’s GDP deflator showed that domestic price pressures remain weak. While the economy is not in a recession, below-trend GDP growth means the output gap is gradually widening. This is reflected in the weakness of prices and suggests the RBA will cut again. Our economists see August (when the RBA updates its forecasts) as the most likely month for a rate cut,

2. Support from China to continue to fade. The March-April rebound in the AUD was helped by an improvement in sentiment towards China as policy stimulus led to an improvement in economic activity and boosted commodity prices. Our China economists note that this week’s China PMI release indicates economic growth was stable in May, but the narrowing of the gap between new orders and inventories suggests growth will slow ahead. PMIs across the rest of Asia are also not very encouraging. Although iron ore prices declined 25% in May, they remain 20% above the year’s low leaving them room to fall further on any negative news.

3. Implications of expectations regarding US rates. From a statistical perspective, interest rate spreads have not been a key driver of AUD crosses in the past 12 months; commodity prices and global risk appetite have been more important. In May, however, there was a recoupling between the AUD and rate differentials, especially for AUDUSD. Recent relationships suggest a reversal of the past two weeks’ rise in US rate-hike expectations could push AUDUSD back up to 0.7350. As a result, we see other AUD crosses as more attractive for short positions in the AUD. Our favourite trade is long EURAUD.

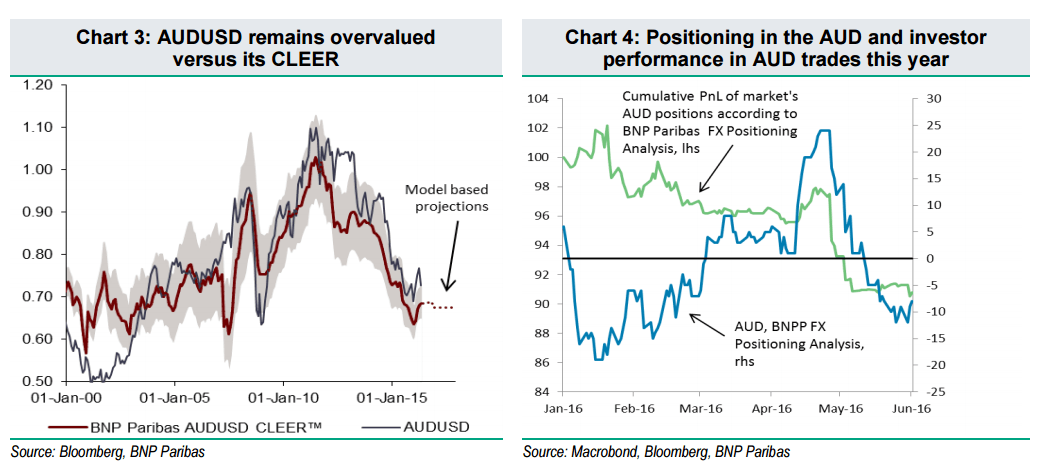

4. Valuation. BNP Paribas CLEER, our macro-based forecasting model, indicates downward pressure on the AUD. The current CLEER (cyclical equilibrium exchange rate) for AUDUSD lies at 0.68. This suggests that, although the pair has fallen since April, it remains overvalued, failing to fully reflect the deterioration in Australia’s terms of trade. During AUDUSD’s decline from its 2011 high, the pair has tended to lag the fall in its CLEER as Australia’s fundamentals have deteriorated. This has left the currency overvalued for period of times before correcting towards its fair value.

5. Positioning. FX investors have had a tough time with the AUD this year, being caught short when the currency started to rally at the start of 2016 and then long when it weakened in May. In recent weeks, overall positioning has returned to a net short, but remains light at -11 (out of +/- 50). A lack of appetite from FX investors to enter large short AUD positions may explain why the currency trades above its CLEER and why it has failed to break below its 200-day moving average at 0.7256.

Trade ideas: Long EURAUD remains the best way to position for further AUD weakness, in our view. In our portfolio of recommendations, we continue to hold a call fly (buy 1x 1.52, sell 2x 1.57, buy 1x 1,62). This structure is attractive to hold as it will benefit from any rise in the pair to 1.57 over the next two weeks and gain value as the maturity approaches.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.