- ALL: EU Summit commences in Brussels today, with Spain, Greece and banking union the three major topics under discussion.

- USD: Jobs continue to hold the key for Fed policy, so today’s jobless claims figures at 12:30 will be closely scrutinised. Also watch Bloomberg consumer comfort figures at 13:45 – consumer sentiment has been strengthening recently, helped by wealth gains from stocks and a better labour market.

- GBP: The jobs market is strong, but this is not translating into spending, at least not yet. Today’s retail sales figures at 08:30 GMT will test that thesis.

Idea of the Day

Our suggestion that both the yen and the dollar would struggle against the other majors in the near term continues to bear fruit, although we are now at an important juncture with this trade. For instance, EUR/JPY has retraced almost 61.8% of the March-July down-move. Care now required with euro and Aussie longs.

Latest FX News

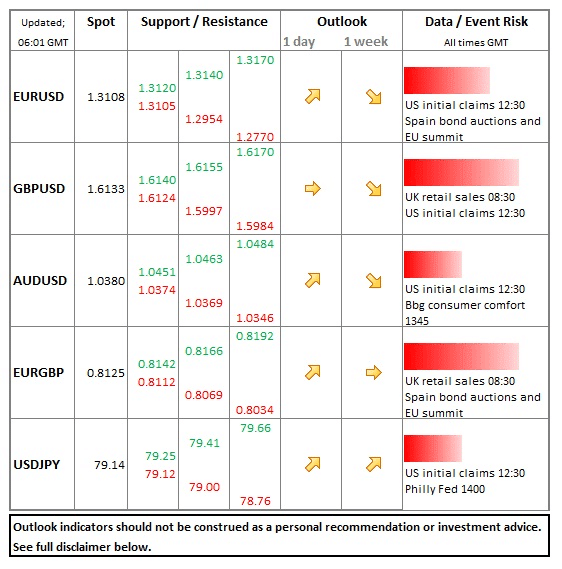

- EUR: A critical time for euro bulls, with yesterday’s high of 1.3140 falling short of the post-QE3 announcement high of 1.3172. Momentum looks healthy, and risk appetite has been improving, but is this a false dawn? Bulls will want the September high taken out ASAP to reassure.

- USD: Still on the back-foot as investors continue to be encouraged by developments in Europe and adopt a more relaxed view towards growth assets.

- GBP: More evidence of strength in the labour market provided sterling with a boost yesterday. MPC seems divided on need for more QE. Pound still struggling vs. resurgent euro.

- AUD: Aussie bears remain incredibly frustrated amidst improved risk appetite. Also, offshore demand for Australian bonds and equities still very strong – yesterday’s 10yr benchmark bond auction was 5x oversubscribed! Playing the 1.02-1.06 range still seems the best strategy.

- CNY: Another 19yr record high for the RMB as Beijing successfully avoids the yuan occupying centre-stage in the US presidential election campaign. The economy also looks steadier, despite a weak Q3 GDP outcome. Expect pro-growth policies once the new political leadership beds down.

- CAD: CAD continues to underperform other majors. Traders are squaring up ultra-long positions, amidst signs that the economy is weakening markedly. EUR/CAD continues to head higher, has almost reached our 1.30 target.