Idea of the Day

Half way through August and the one thing we don’t have is a crisis. This is in contrast to last year when the Eurozone crisis was coming to a head and the year before when it was the US budget ceiling crisis. Our measure of peripheral spreads in Europe, which weights (by GDP) yields premiums over Germany for Greece, Portugal, Ireland, Spain and Italy moved to the lowest level for the year yesterday, to levels last seen 16 months ago. Whether the worst is behind us remains debatable, but it’s notable how we’ve seen the shift, with investors (according to latest ML fund manager survey) more concerned over China’s credit situation rather that the Eurozone. It’s been a long time coming, but it’s a major shift. For FX, it means the euro has been ignoring the direction impulse from peripheral bonds and more trading like a dollar alternative.

Data/Event Risks

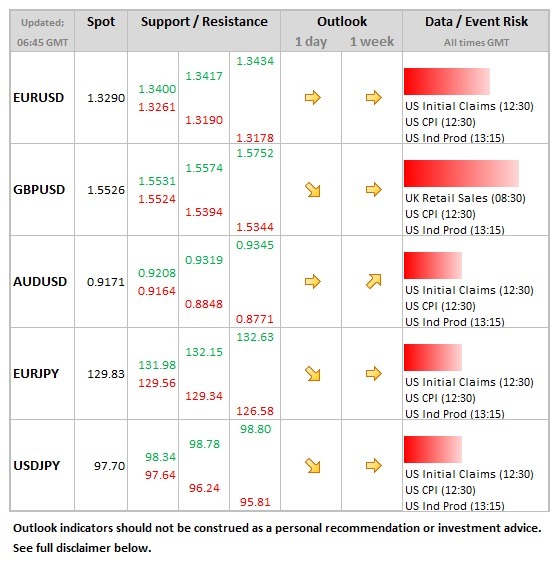

USD: Plenty of dollar data today, with the usual initial claims, but also CPI, industrial production and also the Philly Fed. Inflation seen moving higher on the YoY measure, from 1.8% to 2.0%. Higher would be dollar supportive and would enhance views of Fed tapering come September.

GBP: The retail sales data today are expected to be relatively firm at 0.6% MoM, helped by the much warmer weather during the month. Stronger data would be sterling supportive, but perhaps not as much as before given that we know the BoE is focused on the labour market data.

Latest FX News

EUR: There’s a growing sense that the euro crisis is on the back burner. Indeed, the recent monthly ML survey of fund managers suggested that China was a far bigger concern for investors. Campaigning in the German election is taking off and becoming a focus. The single currency was higher in Asia, up to 1.33 thanks to the weaker dollar tone.

AUD: We’ve seen a broadly weaker US dollar tone during the middle of the week, meaning that the Aussie has moved back towards the 0.92 level. Data on inflation expectations showed them falling.

GBP: The labour market data yesterday saw the unemployment rate steady, but sterling reacted positively owing to better data elsewhere in the report. The move about 1.55 on cable has been sustained during the Asia session.

Further reading:

EUR/USD Aug. 15 – Capped on the upside yet again amid thin liquidity

Eurozone ends recession with a 0.3% growth in the second quarter