- LEND/USD attempts recovery from critical support.

- A significant resistance above $0.60 limits the upside momentum.

Aave’s LEND is the 29th-largest digital asset with the current market capitalization of $751 million and an average daily trading volume of $167 million. The token is most actively traded on Binance. At the time of writing, LEND/USD is changing hands at $0.577, unchanged both on a day-to-day basis and since the beginning of Friday.

Aave is a decentralized protocol where users earn interest by providing liquidity to lending pools or borrow money these liquidity pools. Basically, it is one of the pioneers in the DeFi industry with a wide range of possible practical applications. Recently Aave announced the partnership with RealT and unlocked cryptocurrency mortgages on a blockchain.

LEND/USD: The technical picture

LEND/USD bottomed at $0.472 on September 3 and recovered to $0.775 by September 13. However, the upside momentum failed to gain traction, and the coin retreated below $0.60 amid slow trading activity. On the 12-hour chart, the price moves along the lower line of the symmetrical triangle pattern, which coincides with the SMA100 at $0.55 that has served as a strong support since the beginning of the month. Considering the strong technical support, this area creates a significant barrier for LEND’s bears and may serve as a jumping-off ground for an extended recovery with the initial target at $0.86

LEND/USD 12-hour chart

The market positioning data gives credibility to the above-said support area as there is a cluster of 1.64k addresses holding over 14 million coins with the breakeven point around that level. A move below this area will pull the rug out of LEND as there is virtually no significant support until $0.20.

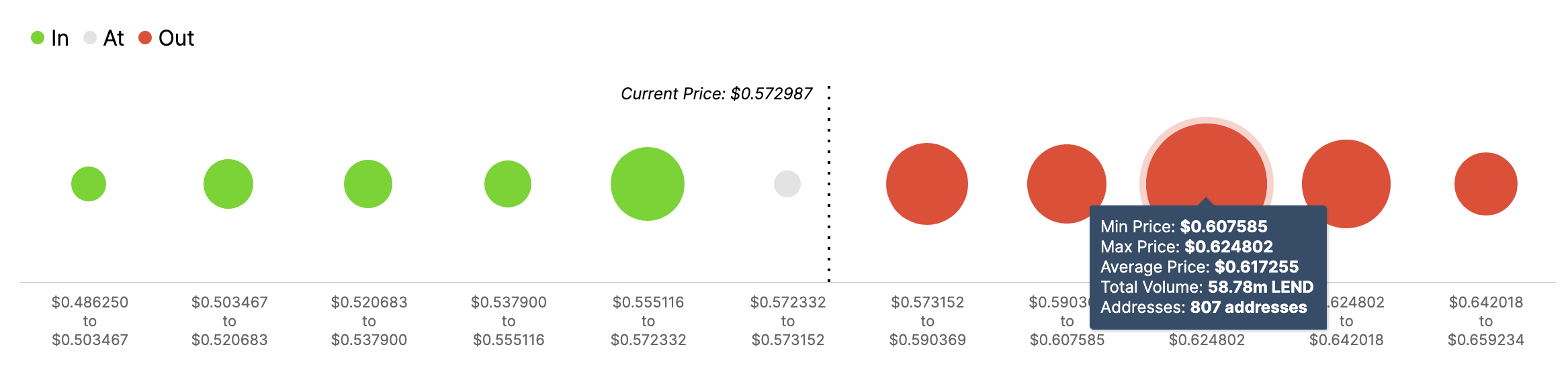

Meanwhile, the upside is cluttered with barriers and limitations. Thus 807 large addresses holding over 58 million tokens wait for the price to approach $0.60-62 to cash out. If these whales decide to sell once they reach their breakeven point, the market will collapse and smash the above-said support area like a house of cards.

LEND’s In and Out of the Money data

Source: Intotheblock

This area is reinforced on the intraday charts by a combination of moving averages and the middle line of the 4-hour Bollinger Band. Once it is out of the way, the recovery may be extended to the upper line of the symmetrical triangle pattern identified on the 12-hour chart at $0.73 and the ultimate target of $0.86.

LEND/USD 4-hour chart

At the same time, it should be noted that LEND’s whales seem to be optimistic about the coin. The number of holders with over 100,000 coins has increased from 346 to 383 in less than a week. As the chart below shows, the whales’ activity diverges from the price movements, creating a positive signal in the long run.

LEND’s Holders distribution

Source: Santiment

To conclude: LEND has reached strong support that may trigger a new recovery way from the short-term perspective. However, we will need to see a strong move above the significant resistance area $0.60-$0.65 to confirm that the recovery is back on track. If this is the case, the next targets of $0.73 and $0.86 will come into focus. A sustainable move below $0.55 will invalidate the favorable scenario and send the price towards $0.20.