- Algorand price is trading inside an ascending parallel channel and indicates a breakout soon.

- The demand zone below the technical formation could dampen the selling pressure that targets $0.84.

- A bullish scenario may come into play if ALGO manages close above $1.53.

Algorand price saw a healthy upswing over the past couple of weeks, but this bullish structure hints at a bearish breakout shortly.

Algorand price primed for a drop

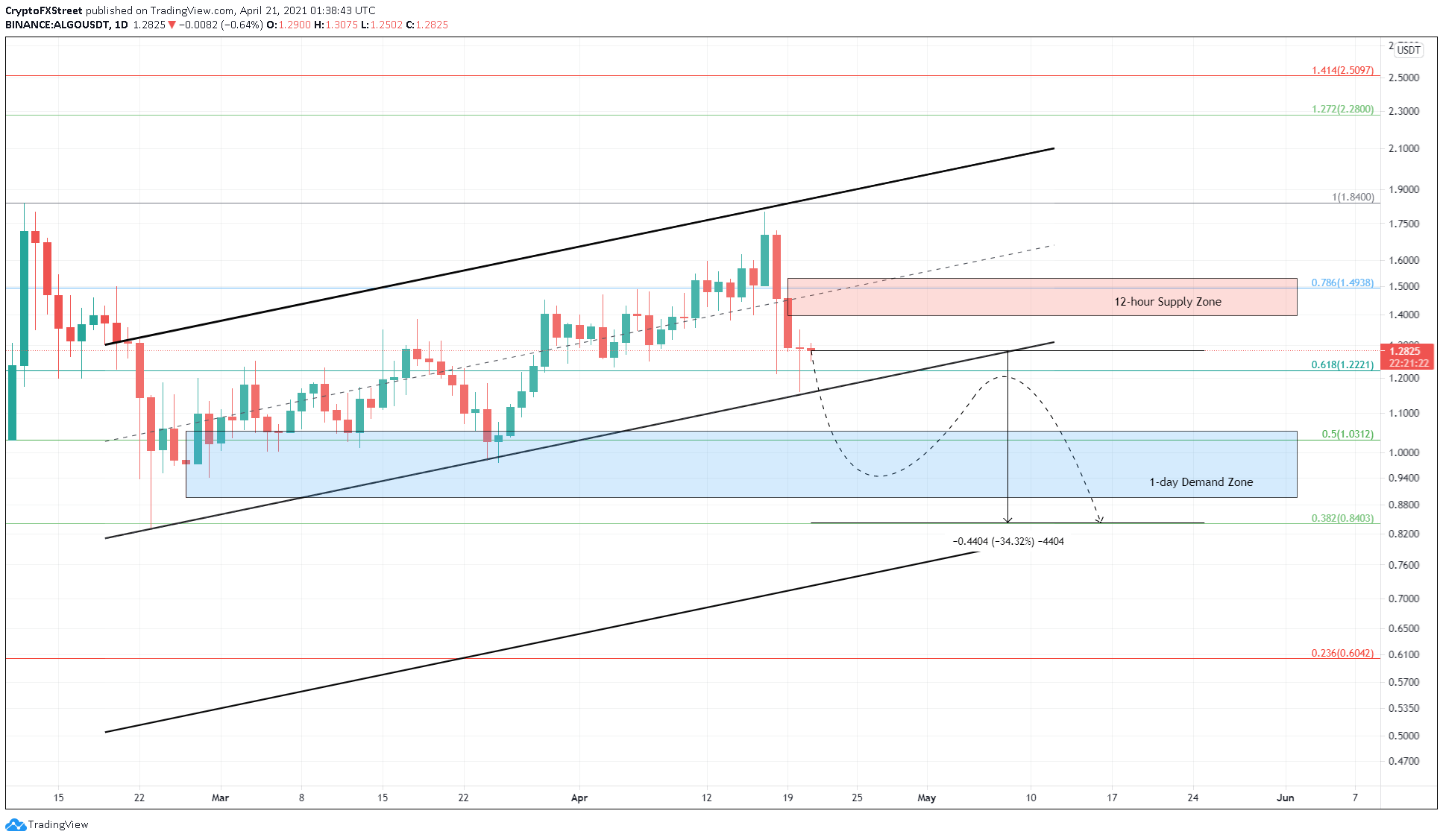

On the daily chart, Algorand price showed promise as it created higher highs and higher lows since February 23. This price action forms an ascending parallel channel when its swing highs and swing lows are connected using trend lines.

So far, ALGO has dropped nearly 30% since April 17, which puts it at $1.28, where it currently trades, just above the lower boundary of the technical formation. If Algorand price slices through the $1.22 level, investors can expect the start of a downward trend.

Under such conditions, the setup projects a 34% drop, which is the channel’s height. Adding this measure to the breakout point at $1.22 yields Algorand price target of $0.84, which coincides with the 38.2% Fibonacci retracement level.

While 34% seems accurate from a theoretical perspective, investors should consider a slow down of this slump around the demand zone that ranges from $0.89 to $1.05.

ALGO/USDT 1-day chart

While things look grim for Algorand price, investors should note that the breakout point at $1.22 coincides with the 61.8% Fibonacci retracement level. Hence, there is a high likelihood that bulls prevent ALGO from breaking below this level.

If the buyers can manage to pile up their bid orders, Algorand price might appreciate in the near term. However, a decisive close above the Supply zone’s upper boundary at $1.53 will add confirmation to the upswing and invalidate the bearish thesis.

Beyond this point, ALGO could climb 20% to retest $1.84.