Australia used to be a British colony, but that’s certainly not the reason that a potential Brexit could have on the Aussie dollar. Here is the scenario from NAB:

Here is their view, courtesy of eFXnews:

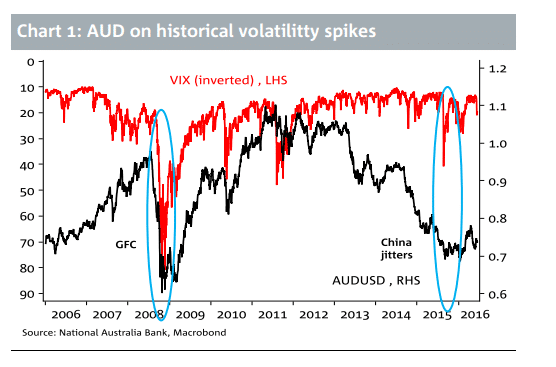

In attempting to quantify the potential implications for the AUD, we note that last August when Chinese stock and currency market-related stresses saw the ‘VIX’ proxy for market risk aversion briefly above 50 from below 20, the AUD fell from above 0.74 to below 0.69.

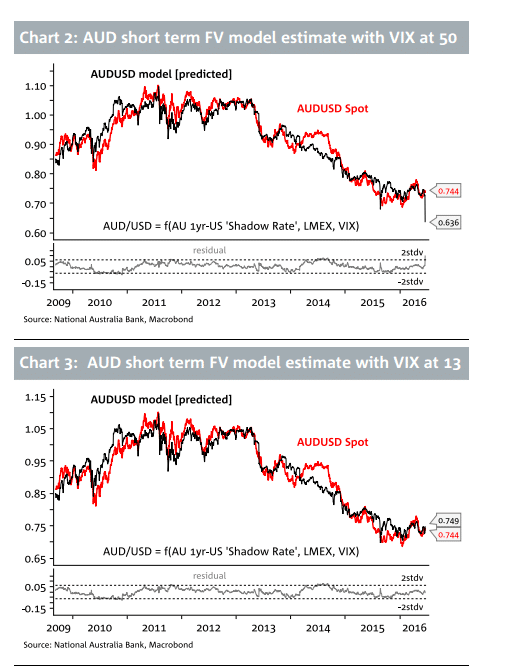

If we go back to the collapse of Lehman brothers when the VIX rose as high as 90, AUD fell from 0.98 to 0.60 (Chart 1). Stressing our short term fair value model with similar levels for the VIX (50 and 90) keeping all else constant, we derive fair value estimates of 0.64 (Chart 2) and 0.52 respectively We’d emphasise these are not forecasts, but do serve to illustrate the potential for severe downward pressure in the event that global risk markets are freaked out by a vote for Brexit.

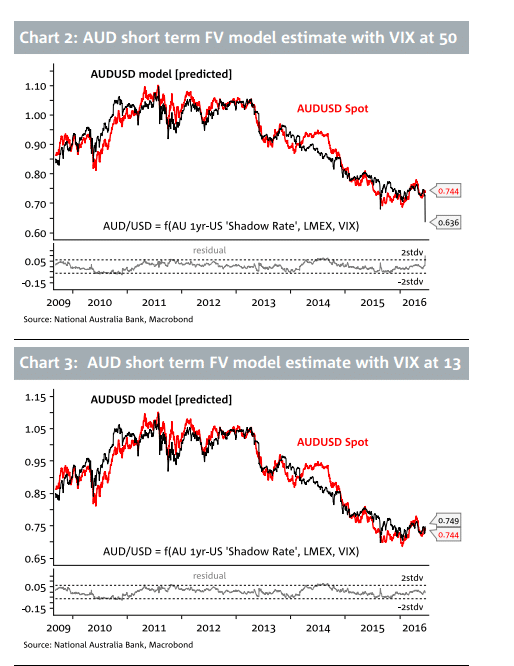

Our sense is that AUD would quickly revisit the current cycle lows in the 0.68-0.69 area in the case of ‘Brexit’ and rally to 0.75-0.76 (based on current levels) in the case of a vote for ‘Remain‘ (Chart 3).

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.