- The AUD/CAD pair trades near 0.9455 during the early Asian session on Thursday.

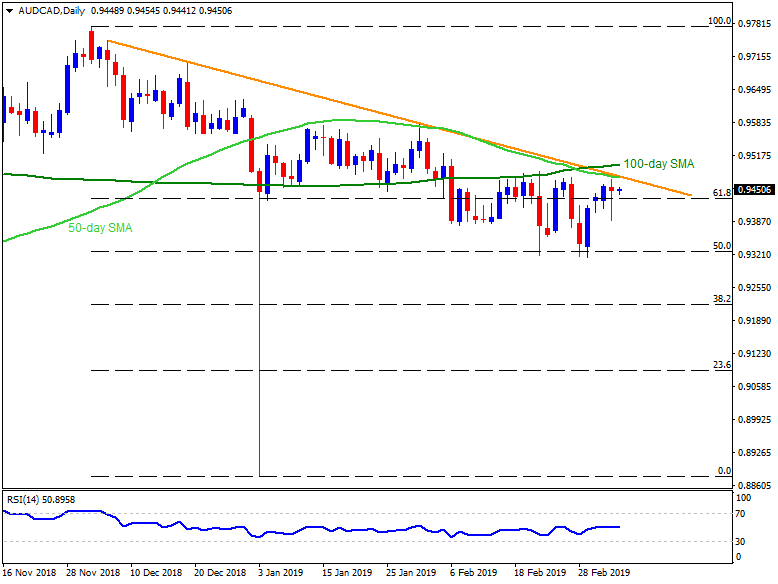

- The quote again heads to 0.9475/80 resistance confluence including 50-day simple moving average and a downward sloping trend-line stretched since December 05.

- However, Australian retail sales and trade balance data can drag the pair down if flashing weak signals.

- On the downside, 0.9380 and 0.9315 likely nearly support for the pair traders to watch.

- Should prices slide under 0.9315, 0.9270 and 0.9220 can please sellers.

- Meanwhile, an upside clearance of 0.9480 may have to surpass 100-day SMA level of 0.9505 in order to justify its strength in targeting late-January high of 0.9580.

- Additionally, the AUD/CAD pair’s successful trading above 0.9580 enables it to challenge 0.9630 and 0.9680 resistances.

AUD/CAD daily chart

Additional important levels:

Overview:

Today Last Price: 0.9452

Today Daily change: 12 pips

Today Daily change %: 0.13%

Today Daily Open: 0.944

Trends:

Daily SMA20: 0.9422

Daily SMA50: 0.9481

Daily SMA100: 0.9512

Daily SMA200: 0.9543

Levels:

Previous Daily High: 0.9474

Previous Daily Low: 0.9388

Previous Weekly High: 0.9477

Previous Weekly Low: 0.9315

Previous Monthly High: 0.9557

Previous Monthly Low: 0.9319

Daily Fibonacci 38.2%: 0.9421

Daily Fibonacci 61.8%: 0.9441

Daily Pivot Point S1: 0.9394

Daily Pivot Point S2: 0.9348

Daily Pivot Point S3: 0.9308

Daily Pivot Point R1: 0.948

Daily Pivot Point R2: 0.952

Daily Pivot Point R3: 0.9566