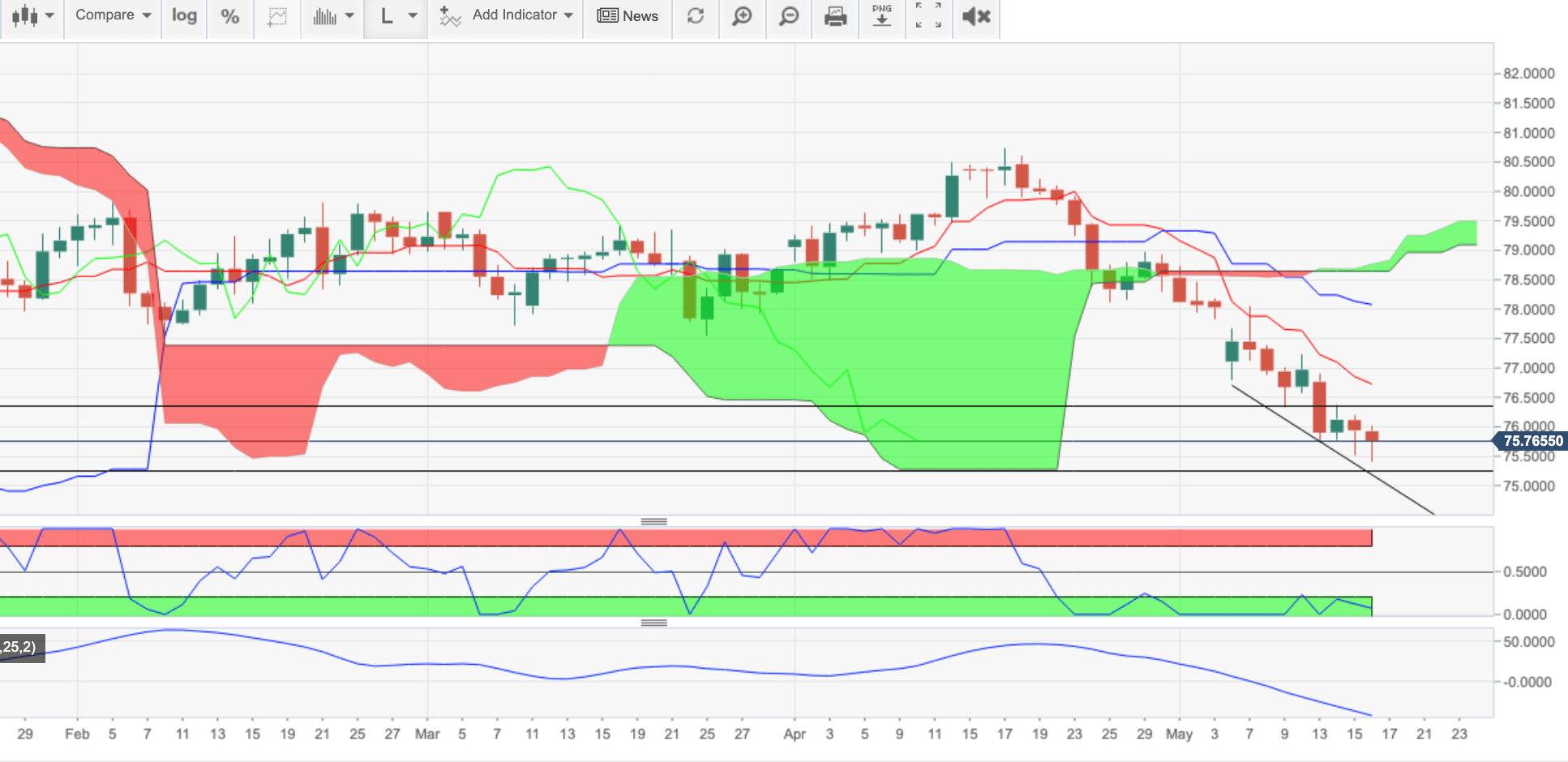

- AUD/USD is weighing on the cross from a technical standpoint, even while the yen has been slammed as U.S. stocks rally on earnings and positive U.S. data.

- AUD/JPY is now back below the 20-hr SMA, hourly trendline support and the 50% Fibo retracement of the flash crash lows to recent swing highs, resisted by the Ichimoku cloud and 50-hr SMA confluence.

- However, on a daily basis, the price has been bought up with volume by the bulls towards the bottom of the steep descending channel and stochastics lean heavily bullish, indicating a run to test the 76.30s could be on the cards, breaking the hourly cloud resistance and meeting channel and 4HR cloud resistance.

- A subsequent break and close above the 76.30s opens the case for a bid to the 76.80, top of 4HR cloud.

- However, general risk-off sentiment puts the old adage, ‘the trend is your friend’, a likely force favouring an extension to the downside, while the price trades below the 50% Fibo. To the contrary of a bullish case for the medium term, therefore, an argument can be made for risk towards 75.20s (4th Jan lows) bottom of the daily cloud/channel and then the 61.8% Fibo down at 74.70.