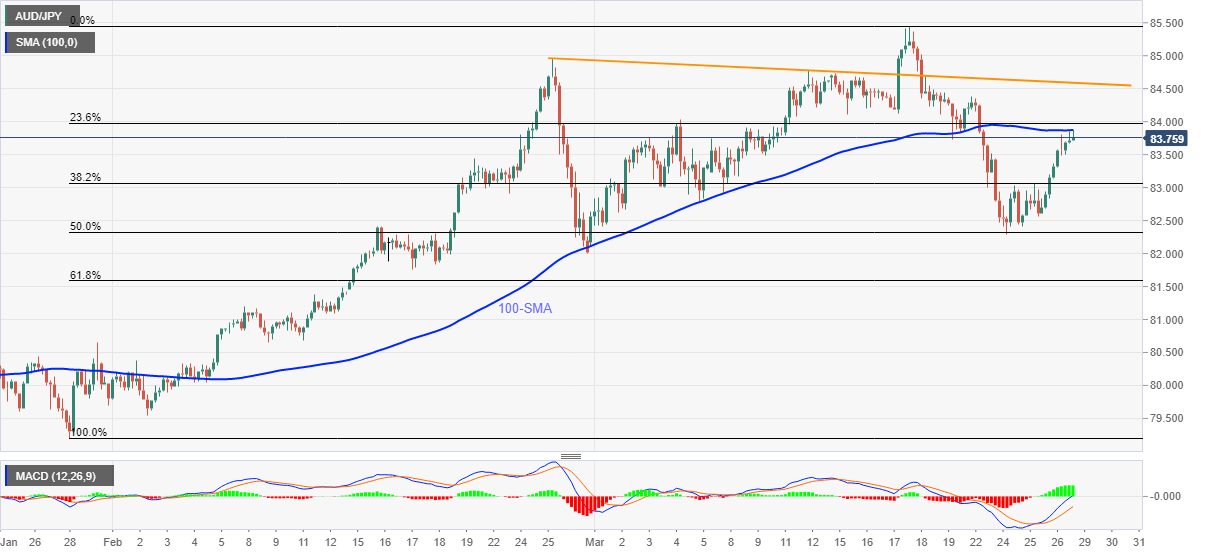

- AUD/JPY eases from 100-SMA, fades last week’s recovery from 50% Fibonacci retracement.

- Bullish MACD signals keep buyers hopeful above the key Fibonacci retracement.

- One-month-old falling trend line adds to the upside barriers.

AUD/JPY fizzles recovery moves from Wednesday while witnessing a pullback to 83.75 amid Monday’s Asian session. In doing so, the quote steps back from 100-SMA despite keeping the last week’s bounce off 50% Fibonacci retracement level of January 28 to March 18 upside.

Although bullish MACD adds to the price-positive catalyst for AUD/JPY, the quote’s latest failure to cross the key SMA can drag it back for a while.

As a result, 38.2% and 50% Fibonacci retracement levels, respectively around 83.00 and 82.30, can entertain short-term traders.

However, any further downside past-82.30 will be detrimental for the bullish sentiment and can eye the early February tops near 81.40-35 while taking stops near the 82.00 and 61.8% Fibonacci retracement level close to 81.60.

Meanwhile, an upside clearance of 83.90 immediate SMA hurdle isn’t a sure call to the AUD/JPY bulls as a downward sloping trend line from February 25, near 84.60, holds the key to the quote’s run-up targeting the monthly top of 85.45.

AUD/JPY four-hour chart

Trend: Pullback expected