- AUD/JPY recedes from 75.00 after mixed China data, measures to tame the virus outbreak.

- A short-term ascending trend line, trading beyond 200-bar SMA favor the bulls.

- Multiple upside barriers stand tall to challenge the optimists past-75.00.

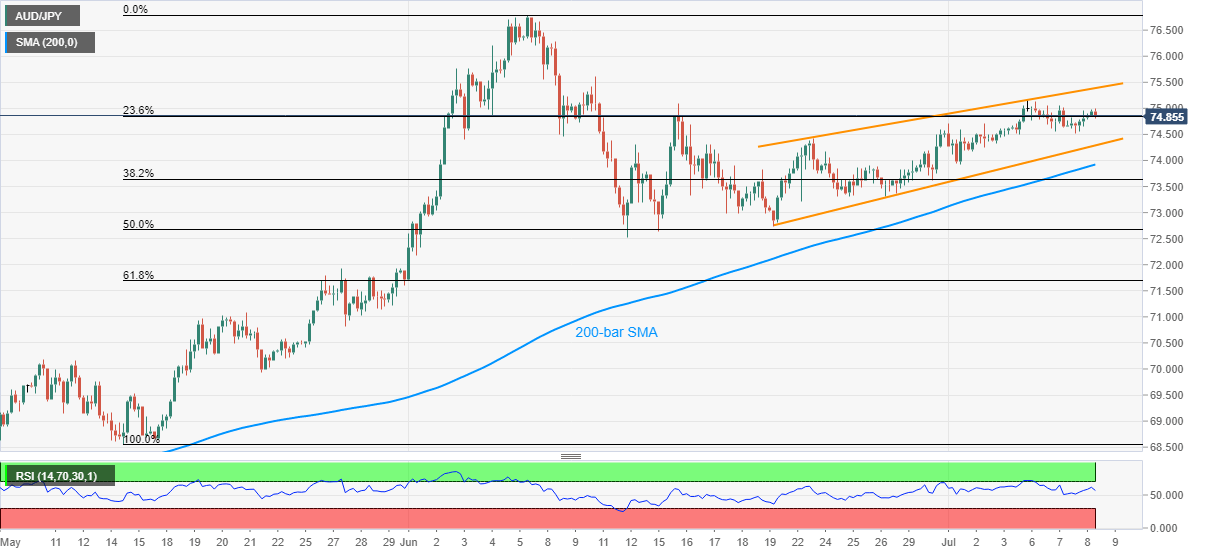

AUD/JPY drops to 74.83, down 0.06% on a day, during the early Thursday. Even so, the pair stays inside a bullish technical set-up above 200-bar SMA, which in turn suggests an additional upside of the quote. However, many resistances could offer a bumpy ride ahead.

Other than the technical pullback from 75.00 round-figures, mixed data from China and Aussie policymakers’ efforts to tame the coronavirus (COVID-19) outbreak, coupled with the recent Hong Kong story.

The pair’s latest pullback aims to revisit the weekly low near 74.50. Though, the support line of the said channel, around 74.30, followed by 200-bar SMA close to 73.90, could question the bears afterward.

In a case where the AUD/JPY prices slip below 73.90, June 12 bottom of 72.52 will be on the sellers’ radars.

AUD/JPY four-hour chart

Trend: Bullish