- AUD/JPY fades corrective pullback from weekly low, flashed the previous day.

- Strong RSI favors further consolidation of losses but key HMA, short-term falling channel test bulls.

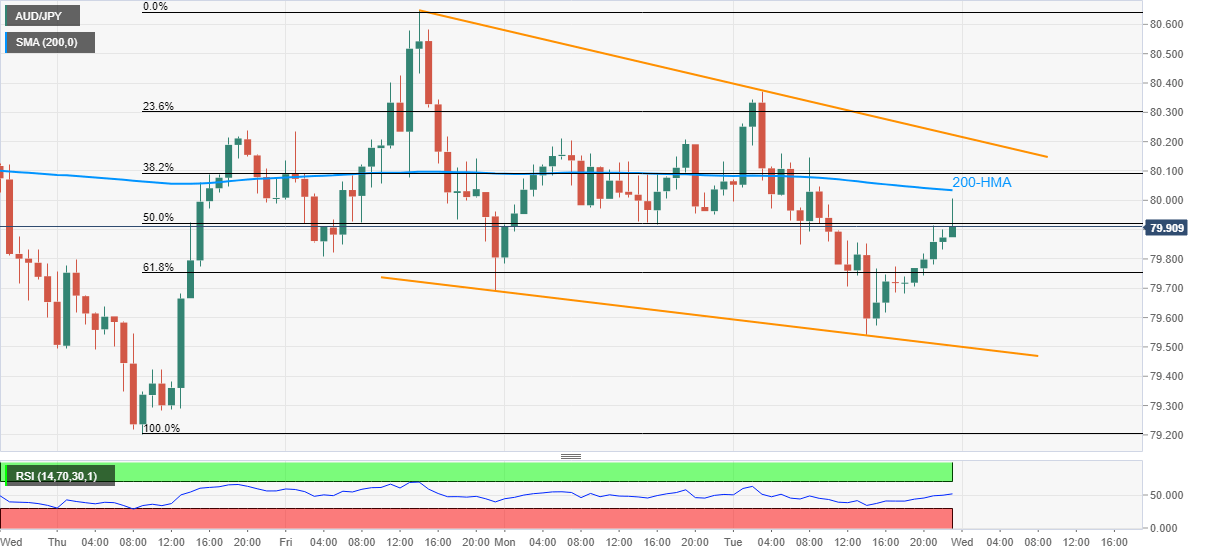

AUD/JPY eases from the intraday top of 80.00 to 79.90 during Wednesday’s Asian session. In doing so, the quote steps back ahead of the key HMA while keeping Tuesday’s corrective pullback from one-week low, marked the same day.

Although 200-HMA guards the pair’s immediate upside around the 80.00 threshold, strong RSI conditions suggest the recovery to last longer.

As a result, a downward sloping trend line from Friday, at 80.22 now, will gain the market’s attention.

However, any further upside beyond the near-term important resistance line will challenge the last week’s top near 80.65 while eyeing January’s high surrounding 80.90-95.

Alternatively, 61.8% Fibonacci retracement of January 28-29 upside, near 79.75, offers immediate support to AUD/JPY trades ahead of the weekly bottom close to 79.55.

In a case where the quote drops below 79.55, a descending support line from Monday, near 79.50, becomes the key before highlighting the 79.00 round-figure and January’s low of 78.85.

AUD/JPY hourly chart

Trend: Pullback expected