- AUD/JPY remains on the back foot despite being above 10-day SMA.

- Bullish MACD, sustained trading beyond short-term SMA favor buyers.

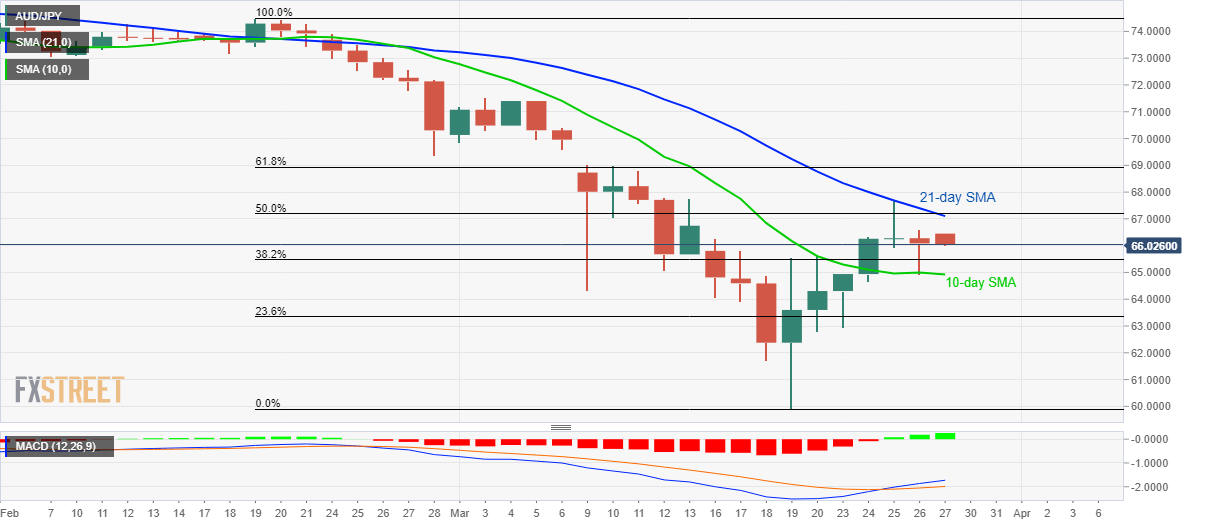

AUD/JPY declines to 66.00 amid the early Asian session on Friday. In doing so, the pair remains below a confluence of 21-day SMA and 50% Fibonacci retracement of its one-month declines from February 19, 2020.

However, bullish MACD and sustained trading beyond 10-day SMA increases the odds for the pair to keep the strength, which in turn raises hopes for the buyers’ entry beyond 67.10/20 resistance confluence.

In that case, 61.8% Fibonacci retracement level around 68.95/69.00 will be on the bulls’ radar ahead of 70.00 psychological magnet,

On the contrary, the pair’s daily closing below the 10-day SMA level of 64.90 can extend the weakness towards 23.6% Fibonacci retracement level of 63.35.

However, the bears may remain cautious unless the quote slips below 62.40/35 support area that holds the key to the sub-60.00 mark.

AUD/JPY daily chart

Trend: Pullback expected