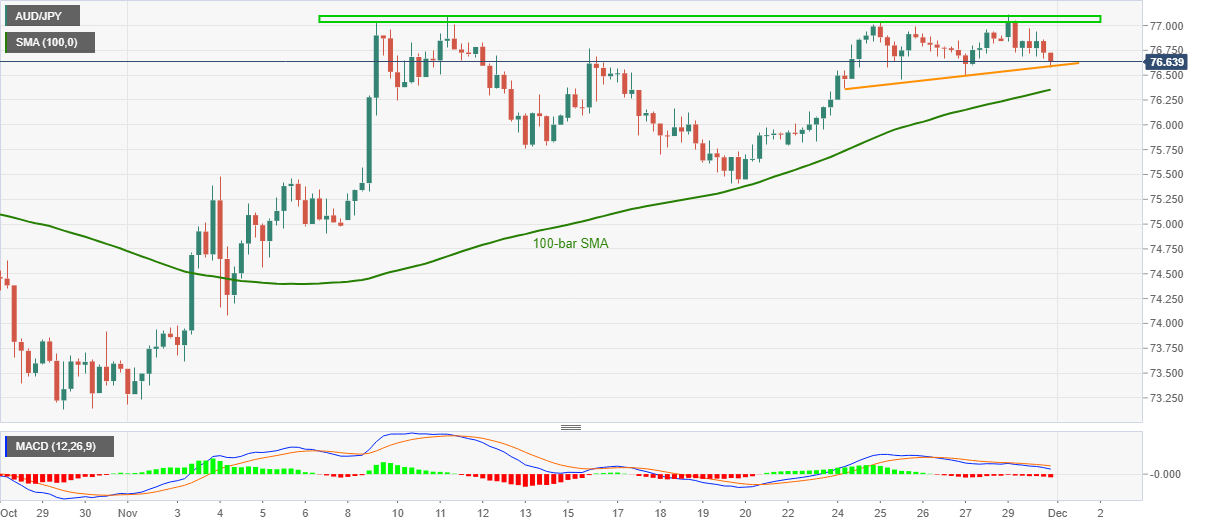

- AUD/JPY battles short-term support after retreating from mid-September high.

- Bearish MACD, challenges to risks weigh on the quote ahead of the key RBA.

- 100-bar SMA offers strong support, bulls can look for entries above 77.11.

AUD/JPY stays depressed around 76.60 during the early Tuesday morning in Asia. Even so, an upward sloping trend line from last Tuesday restricts the immediate downside.

While economic fears, conveyed by the US Fed Chair Jerome Powell, seems to weigh on the quote, bearish MACD suggests further downside. However, sellers are waiting for the RBA monetary policy decision, up for publishing at 03:30 AM GMT, for fresh impulse.

Read: Reserve Bank of Australia Preview: How long could policymakers remain confident?

Although the RBA is widely anticipated to refrain from any fresh moves, a downward revision to the economic forecasts will be closely observed to break the 76.60 immediate support line.

However, 100-bar SMA near 76.35, the 76.00 round-figure and November 19 low around 75.40 are likely tough nuts for the AUD/JPY bears to crack afterward.

Alternatively, the 77.00 threshold can offer immediate resistance ahead of highlighting the area surrounding 77.10 that includes highs marked since September 16.

Should the bulls manage to cross 77.11, September 10 high around 77.75 can offer a halt during the upward trajectory targeting the yearly peak close to 78.50.

AUD/JPY four-hour chart

Trend: Further weakness expected